COVID-19 Ticker: Pandemic News in Legal Context

H.R. 7010 Makes Significant Changes to PPP Loan Forgiveness Requirements

June 5, 2020

Business, Corporate and Securities David Bracht Michael Alvano

This morning, President Trump signed the Paycheck Protection Program Flexibility Act, which Congress passed earlier this week. This legislation adds flexibility to the Paycheck Protection Program (PPP). Among other things, the legislation changes the requirements for PPP loan forgiveness including:

- Extending the “covered period” from the original eight weeks to 24 weeks after the loan is received, during which eligible costs will support loan forgiveness;

- Reducing the amount of PPP loan proceeds that must be used on payroll costs to be eligible for forgiveness to 60% (from 75%); and

- Adding more flexibility for employers to avoid reduction of forgiveness due to reduced FTEs.

The changes apply to new PPP loans and to the $510 billion of PPP loans issued since April 2020. Additional regulations and other guidance reflecting the changes are expected to be issued soon, which will be addressed in future client alerts.

Applications for PPP loans are available until June 30, 2020 or until the remaining $148 billion of the total $659 billion authorized for the PPP loans has been expended. Information about PPP loans is also available from the Small Business Administration.

Updated Guidance on Economic Uncertainty Certification under the Paycheck Protection Program

May 13, 2020

Business, Corporate and Securities David Bracht Amy Bagnall

The U.S. Department of the Treasury's new FAQ guidance issued today (Wednesday) concerns interpretation of the Economic Uncertainty Certification made in the PPP loan application. In short:

- Any PPP borrower with less than $2.0 million original loan balance is deemed to have made the economic uncertainty certification in good faith.

- If SBA determines that the economic uncertainty certification was not valid for any PPP borrower with $2.0 million or more original loan balance, the borrower may repay the loan and avoid any other ramifications from the certification.

To be clear, for a large loan (above $2.0 million) the economic uncertainty certification is still subject to SBA review, but the ramifications of a contrary finding by SBA are reduced. The safe harbor date is still May 14, 2020, but it obviously has much less significance now.

Employers Encouraged to Use Specific FFCRA Leave Request Forms

April 1, 2020

Employment Law Marcia Washkuhn

Based on recently issued IRS guidance, to obtain tax credits available under the Families First Coronavirus Relief Act (FFCRA) for paid leave taken by employees under the FFCRA, employers must obtain and retain written statements and documentation to support the need for leave. In light of this guidance, employers should consider adopting and using FFCRA-tailored leave request forms that seek the required information.

Colorado Department of Labor and Employment issued a worksheet identifying COVID-19 Pandemic Scenarios and Benefits Available

April 1, 2020

The CO DOL advises employees to wait to file a claim until the department receives official guidance from the U.S. Department of Labor for implementation of the CARES Act and the Pandemic Unemployment Assistance. The worksheet provides expanded coverage, including for employees who “were scheduled to start work and do not have a job as a result of COVID-19” and for individuals who “have become the major support for a household because the head of the household died as a direct result of COVID-19.”

USPTO Provides Deadline Extensions Through CARES Act

April 1, 2020

Intellectual Property Brian Main Bryan Stanley

The United States Patent and Trademark Office (the USPTO) is extending certain deadlines by 30 days in accordance with the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). Currently, the eligible period includes those deadlines falling on and between March 27, 2020 and April 30, 2020, but other relief may be available for deadlines falling outside of this range.

In order to take advantage of this relief, the delayed filing or payment must be accompanied with a notice indicating that the delay is due to the COVID-19 outbreak. Even if you have not been affected by COVID-19, the current work-from-home and stay-at-home requirements that have impacted most businesses (including Kutak Rock) should be sufficient for you to qualify for this relief. Accordingly, unless instructed otherwise, we will take advantage of the relief when such relief is beneficial or necessary.

If you have questions or specific instructions, contact a member of our Intellectual Property Group.

Department of Labor issued updated guidance on the Families First Coronavirus Relief

March 26, 2020

Employment Law Rich Olmstead, Marcia Washkuhn, Gigi O’Hara, Diana Fields

The updated DOL guidance answers many questions employers had, including whether sick pay or expanded leave may be used on an intermittent basis, the documentation and proof required to support the need for sick pay or if an employee claims paid leave due to the closure of a child’s school or childcare provider, and an expansive definition of “health care provider” for determining which employees could be excluded from the paid leave requirements.

Major Disaster 401(k) and 403(b) Hardship Withdrawals

March 26, 2020

Employee Benefits Michelle Ueding

A number of 401(k) and 403(b) plan sponsors have asked whether hardship withdrawals can be given for COVID-19 related expenses. Under recent regulations, plans may allow hardship distributions expenses incurred due to a federally declared major disaster. The federal state of emergency declared by President Trump does not qualify for this purpose. However, if a participant lives or works in a state that FEMA has declared a major disaster, a hardship withdrawal may be possible. The list of states that FEMA has declared a major disaster is constantly changing.

The following states are currently included:

- California

- Iowa

- Louisiana

- Washington

- New York

- Texas

- Florida

- North Carolina

- New Jersey

If you want to allow hardship distributions for people in these states for COVID-19 reasons:

- Contact your record-keeper or TPA (if they approve hardships for your plan) and ask whether hardship distributions for major disasters may be “turned on” for your plan; and

- Notify us, so we can make sure your plan is properly amended when required (generally by the end of 2021).

If you have any questions, please contact the Employee Benefits Group.

We are also watching the CARES Act, approved last night by the Senate, which has COVID-19 related hardship and loan provisions. We will provide you details on the CARES Act soon.

Arizona Governor Issues New Order Anticipating Influx of COVID-19 Cases

March 26, 2020

Arizona

Healthcare Government Relations Daniel Romm

Earlier today, Governor Doug Ducey issued his 10th Executive Order since declaring a statewide health emergency two weeks ago. In anticipation for an influx of patients due to the coronavirus outbreak, the Governor’s latest order requires hospitals to increase the amount of hospital bed capacity in the state, take steps to optimize staffing levels, and maximize critical resources. The order also directs pediatric hospitals to admit patients up to age 21 and reroute noncritical patients to other providers.

As of this morning, Arizona had 508 total confirmed cases across the state with eight known deaths. The level of community spread in just the last day has gone from moderate to “widespread.”

You can view the full Executive Order here (PDF).

Summary of Paid Sick Leave and COVID-19 Laws

March 26, 2020

Employee Benefits Alexis Pappas

The Families First Coronavirus Relief Act (“FFCRA”) created two new types of paid leave. The law requires most employers with fewer than 500 employees to comply with these new requirements starting April 1. This table briefly describes types of paid and unpaid leave laws that may apply to employers and their workforces, including the newest requirements under the FFCRA.

If you have any questions regarding this table or how various leave laws interact, please contact a member of the Employee Benefits or the Employment Law group.

DOL issues free updated notice poster required by the Families First Coronavirus Response Act (FFCRA)

March 26, 2020

Employment Law Marcia Washkuhn

On March 24, the United States Department of Labor (DOL) issued an updated notice poster required by the Families First Coronavirus Response Act (FFCRA). The notice can be obtained free of charge at the DOL’s Wage and Hour Division at 1-866-4-USWAGE (1-866-487-9243) or downloaded and printed from https://www.dol.gov/agencies/whd/posters. Each covered employer (i.e., private employers with fewer than 500 employees and certain public employers, regardless of size) must post a notice accessible to its employees. An employer may satisfy this requirement by emailing or direct mailing this notice to employees or posting it on an employee-accessible internal or external website. With so many employees working remotely due to the COVID-19 pandemic, electronic postings or notices may be necessary for some or all of your workforce. Currently, employers are not required to post the notice in multiple languages, but the DOL is in the process of translating it. For physical worksites, the notice needs to be displayed in a conspicuous place where employees can see it, but, if all employees are able to see it at the main office or at one location, it is not necessary to display it at all other worksites. Recently laid-off employees and new job applicants do not have to receive the notice, but it must be provided to new hires. You can sign up to receive any new or updated notice requirements at www.dol.gov/agencies/whd.

Kutak Rock’s National Insurance Group Responding to New Coverage Concerns, Cases

March 26, 2020

Insurance Coverage and Bad Faith Litigation Larry Fields Courtney Koger

Many businesses are thinking about insurance coverage in ways they never previously considered. Lawsuits are already being filed seeking business interruption and coverage for COVID-19-related closures. State legislators have introduced bills that would provide business interruption coverage for global pandemics. Questions about business interruption coverage are likely only the tip of the iceberg. In the coming months, we anticipate COVID-19 coverage questions affecting several types of policies.

For example:

- Commercial general liability coverage for bodily injury arising from exposure to and/or contraction of COVID-19 or for bodily injury suffered while attempting to obtain necessities

- Directors and officers liability coverage for acts and omissions related to COVID-19 policies, closures, and financial management

- Professional liability coverage related to financial advising before or during the market downturn

- Professional liability coverage for healthcare workers providing treatment, including decisions not to provide testing or treatment

- Workers’ compensation coverage for employees, particularly employees in essential services continuing to work

Kutak Rock’s Insurance Group has significant experience addressing novel claims and is prepared to address the COVID-19 insurance questions that your company may face—or that your company is already facing.

State Legislatures Seek to Create COVID-19 Business Interruption Coverage

March 26, 2020

Insurance Coverage and Bad Faith Litigation Michael McDonnell III Meredith Webster

New Jersey led the charge of introducing A-3844, a bill to provide retroactive business interruption insurance coverage for COVID-19-related losses. Massachusetts and Ohio have just followed suit with H.B. 589 and S.D. 2888. The key hurdle to business interruption coverage has been that COVID-19 does not qualify as a covered cause of loss. Traditionally, specified causes of loss in the standard business interruption coverage form focus on physical damage to property. Business income loss and extra expense coverage flow from the property damage. Some policyholders are contending that the time that COVID-19 lives on physical surfaces satisfies the traditional property damage requirements for a covered cause of loss. Of course, there is also the issue of exclusions. It is not uncommon for first-party policies to include virus exclusions. These exclusions would preclude coverage even if COVID-19 qualified as a covered cause of loss. The legislation that states like Massachusetts, New Jersey, and Ohio are introducing overcomes both of these obstacles and generally would provide coverage for business interruption losses caused by a global pandemic, subject to state-specific limitations. The insurance industry has opposed this type of legislation because it changes the risk that carriers agreed to write. Some also have argued that these legislative proposals upend contract law to accommodate newly emerging public policy. None of these bills has been enacted into law yet. It remains to be seen how many other states will introduce similar bills and how courts presiding over the small number of lawsuits that have been filed in the last two weeks will decide these coverage questions in the absence of legislation.

Arizona Governor Ducey Requests Special Enrollment Period

March 25, 2020

Arizona

Healthcare, Government Relations Daniel Romm

Arizona Governor Doug Ducey has requested Secretary of Health and Human Services Alex Azar to open a special enrollment period on the Federal Insurance Marketplace. If granted, the action would allow individuals who have recently lost a job or had their income reduced due to COVID-19 to access healthcare on the federal marketplace.

Banking Regulators Provide Interagency Statement, will Host Webinar on Coronavirus-Related Loan Modifications

March 25, 2020

Banking, Finance Stuart Hindmarsh

On Sunday, March 22, federal banking regulators (including the FRB, FDIC, OCC, NCUA, and CFPB) and the Conference of State Bank Supervisors issued their Interagency Statement on Loan Modifications by Financial Institutions Working with Customers Affected by the Coronavirus (available at: https://www.fdic.gov/news/news/press/2020/pr20038a.pdf). The Statement encourages financial institutions to be proactive in working with borrowers affected by COVID-19 and provides guidance on topics relating to such modifications, including accounting, past due reporting, nonaccrual status and charge-offs, and discount window eligibility. On Friday, March 27 at 2 PM Eastern Time, federal regulators will be holding a joint webinar for bankers to raise awareness regarding of the Statement. Information regarding how to join the webinar and how to submit questions to regulators in advance can be found at: https://www.fdic.gov/news/news/financial/2020/fil20024.html.

“UPDATE: Tomorrow’s webinar scheduled for 2:00 p.m., eastern time, has been postponed due to recent legislative developments that could impact the Interagency Statement on Loan Modifications and Reporting for Financial Institutions Working with Customers Affected by the Coronavirus announced earlier in the week”

Arizona Governor Expands Telemedicine Coverage

March 25, 2020

Arizona

Government Relations Daniel Romm

Arizona Governor Ducey has issued an Executive Order (PDF) requiring healthcare insurance companies to expand telemedicine coverage for all services that would normally be covered for an in-person visit. The order prevents insurers from charging more for a telemedicine visit than they would for an in-person visit. Arizonans who may be sick or under quarantine can access care from their homes and avoid potentially risky trips to the doctor. It remains in effect until the termination of the declared public health emergency. This is Governor Ducey’s ninth Executive Order directed at handling coronavirus.

Department of Labor issues guidance on Families First Coronavirus Relief Act

March 25, 2020

Employment Law Gigi O'Hara Diana Fields Richard Olmstead

The Department of Labor uses the FMLA’s “employer” definition, including either “joint employer” or “integrated employer” for calculating FFCRA 500 employee threshold. FFRCA is not retroactive—any leave provided to date does not count toward the 80 hours of paid sick leave required on the effective date of FFCRA. DOL says the paid leave requirements go into effect April 1, 2020, a day earlier than calculated under FFCRA.

$340 Billion Surge in Emergency Funding to Combat COVID-19 Outbreak

March 25, 2020

Government Services Seth Kirshenberg

The initial summary of the bipartisan Coronavirus Aid, Relief, and Economic Security (CARES) Act (PDF), which contains $339.855 billion in emergency supplemental appropriations to aid Americans during the coronavirus crisis is now available. The Bill is expected to pass the House and Senate by tomorrow, March 26. This comprehensive package brings to bear the full resources of the federal government to protect the health and well-being of all Americans. More than 80% ($274.231 billion) of the total $339.855 billion provided in the coronavirus emergency supplemental appropriations package goes to state and local governments and communities.

Highlights include:

- $117 billion for hospitals and veterans Healthcare

- $45 billion for the FEMA Disaster Relief Fund

- $16 billion for the Strategic National Stockpile

- $4.3 billion for the Centers for Disease Control

- $11 billion for vaccines, therapeutics, diagnostics, and other medical need

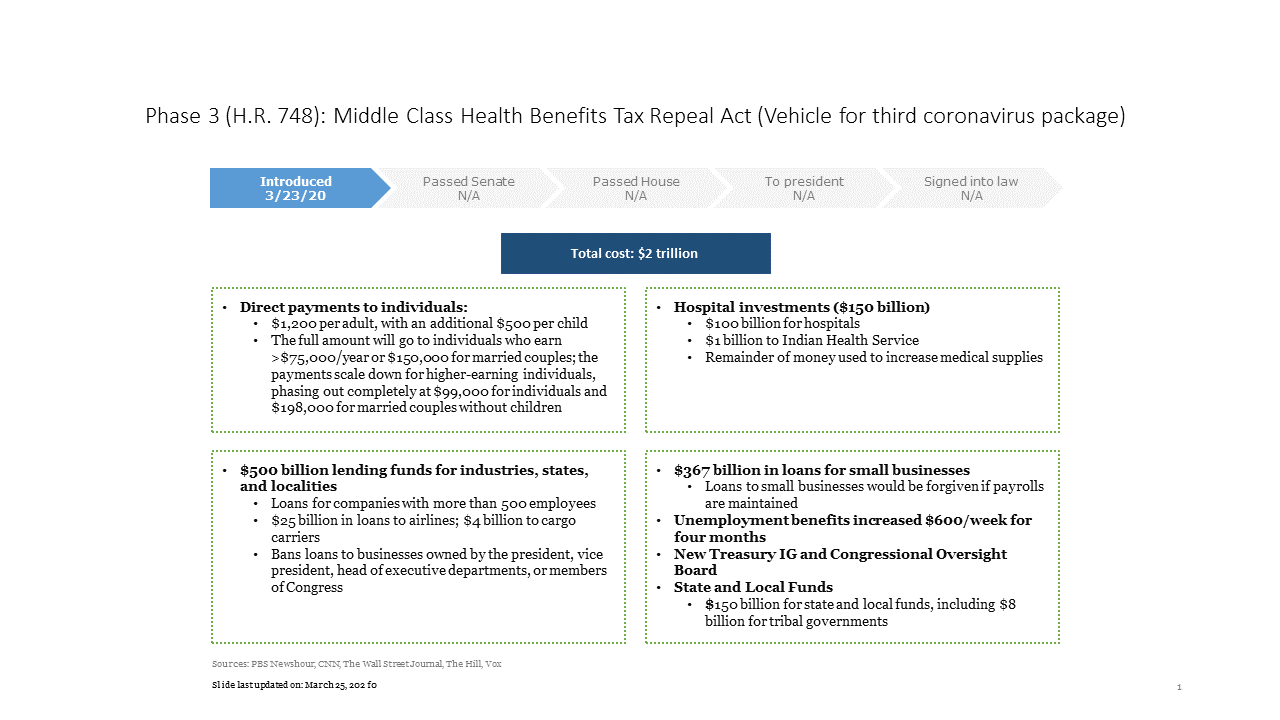

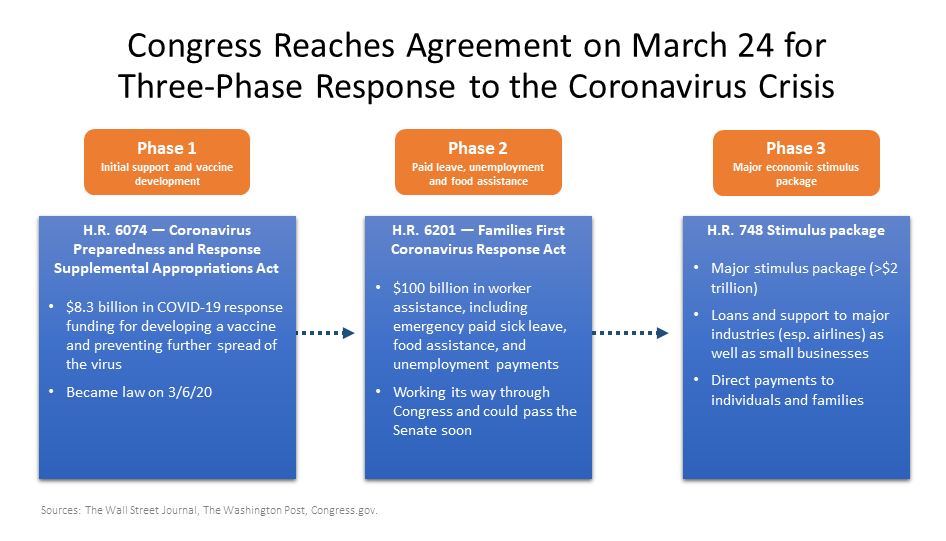

Congress Reaches Agreement on Three-Phase Response to COVID-19

March 25, 2020

Government Services Seth Kirshenberg

The latest COVID-19 bill was agreed on overnight. Once the bill passes we will have more detail. The graphic below shows what is in each bill.

Colorado Statewide Stay at Home Order Allows Non-Essential Businesses to Remain Open if Employers Can Certify 6-Foot Separation at Workplace

March 25, 2020

Colorado

Governor Polis implemented a Colorado statewide restrictive Stay at Home Order (PDF), which went into effect at 8 a.m. March 24, 2020. It mandates that non-critical businesses reduce their in-person workforce by 50% unless the employer can certify that employees are no closer than 6 feet from one another during any part of their work hours. The Colorado Department of Public Health and Environment issued a public health order (PDF) implementing the Stay at Home Order and promises a method for determining how an employer can certify the 6-foot distance. Employers also need to review county and municipal Stay at Home Orders that might be more restrictive.

AZ Governor Issues New Executive Order Delaying Evictions

March 24, 2020

Arizona

Government Relations Daniel Romm

Today Arizona Governor Doug Ducey issued a new executive order, delaying evictions for renters hit by the coronavirus. The order applies to renters who are quarantining due to the coronavirus or facing economic hardship as a result of the outbreak.

Governor Ducey Launches Arizona Together

March 24, 2020

Arizona

Government Relations Daniel Romm

Earlier today Governor Doug Ducey launched a new online resource to assist Arizonans during the COVID 19 crisis: arizonatogether.org

The website brings together resources for individuals, businesses and volunteer opportunities. Additionally, people can donate to the Arizona Coronavirus Relief fund to support organizations combating COVID 19.

Fannie/Freddie/HUD Evictions for SF and MF properties - Mortgage Forbearance

March 24, 2020

Yesterday, Fannie and Freddie announced that they are offering mortgage forbearance to multifamily property owners on the condition that they suspend all evictions for renters who can’t pay their rent because of the coronavirus

Fannie/Freddie/HUD Evictions for SF and MF properties - Suspended Foreclosures

March 24, 2020

Last Friday, HUD, Fannie Mae and Freddie Mac suspended foreclosures and evictions on single-family homes as the coronavirus continues to spread

Guidance to Implement COVID-19 Paid Leave and Swiftly Recover Tax Credits

March 24, 2020

Employment Richard Olmstead, Gigi O'Hara

In the category of much-needed good news for employers, the Department of Labor and Internal Revenue Service announced that employers who provide COVID-19 paid leave to employees under the newly enacted Families First Coronavirus Response Act will be permitted to immediately recover those payments by retaining an amount equal to the amount of qualifying sick leave and child-care leave from employees’ payroll taxes, rather than deposit them with the IRS. In the event there are insufficient payroll taxes to cover the amount of paid leave, employers will be able to file a request for accelerated payment from the IRS. Click for the full announcement on Paid Leave and Swiftly Recover Tax Creditswith more detailed guidance and/or regulations expected in the coming days.

Defense Production Act and the COVID-19 Response

March 24, 2020

Government Services Seth Kirshenberg, George Schlossberg

The Defense Production Act (DPA) grants the President a broad set of emergency legal authorities over US industry in the interest of national defense, including responding to the COVID-19, emergency preparedness, acts of terrorism or continuity of government operations. On Wednesday, March 18, the President invoked the DPA via an Executive Order: Prioritizing and Allocating Health and Medical Resources to Respond to the Spread of COVID-19.

On Monday March 23, the President issued a new executive order to prohibit stockpiling and price gouging of medical and emergency equipment which allows the Department of Justice to bring actions against individuals and companies that are violating the executive order. Others have called on the President to use the authority to require production of certain equipment. The authority is very broad and will likely be used more often to address the COVID-19 issues. For background on DPA please see https://fas.org/sgp/crs/natsec/R43767.pdf or contact the attorneys linked to the Government Services page.

FHFA Provides Forbearance with Eviction Relief for Fannie/Freddie Multifamily Properties

March 23, 2020

Real Estate, Public Finance Stuart Hindmarsh

On Monday, March 23rd, the FHFA announced Fannie Mae and Freddie Mac will offer multifamily property owners an option for mortgage forbearance provided there is a coterminous suspension of all evictions for renters unable to pay rent due to the impact of COVID-19. Details of the program have not yet been made available. https://www.fhfa.gov/Media/PublicAffairs/Pages/FHFA-Moves-to-Provide-Eviction-Suspension-Relief-for-Renters-in-Multifamily-Properties.aspx