SEC Adopts Final Rules Requiring New Disclosures Related to Companies’ Share Repurchase Programs

Publications - Client Alert | May 16, 2023On May 3, 2023, the U.S. Securities and Exchange Commission (the “SEC”) adopted final rules requiring new disclosures related to companies’ share repurchase programs. The SEC claims the new rules will provide investors with enhanced information to assess the purpose and effect of share repurchases. As discussed in greater detail below, the new and revised rules will require domestic companies to, among other things:

- Disclose daily repurchase activity quarterly;

- Check a box indicating if directors or Section 16 officers traded in the relevant securities within four business days before or after the public announcement of a company’s new or expanded repurchase plan or program;

- Provide narrative disclosure about the company’s repurchase programs and practices in its periodic reports; and

- Provide quarterly disclosure in the company’s periodic reports on Forms 10-K and 10-Q related to its adoption and termination of 10b5-1 plans.

The final rules require generally the same substantive disclosures as originally proposed in December 2021, but the frequency and manner of such disclosures have changed. For example, the proposed rules would have required companies to file a new form (Form SR) disclosing the execution of share repurchases before the end of the first business day following the repurchase. In the final rules, however, the SEC dropped the Form SR requirement, opting instead to require companies to disclose daily quantitative repurchase data at the end of every quarter.

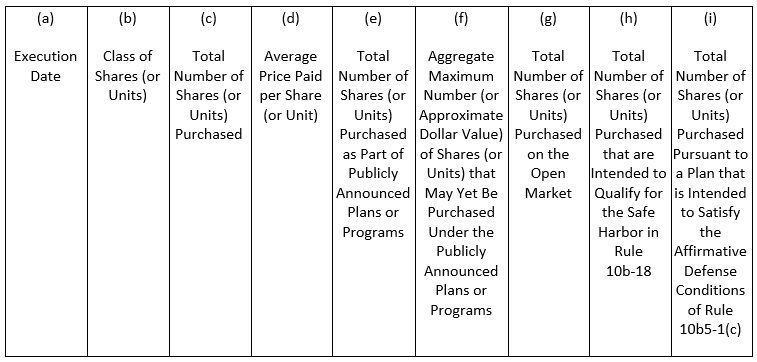

New Tabular Disclosure. The existing disclosure obligations in Item 703 of Regulation S-K, which currently require aggregated monthly tabular disclosure of share repurchases in periodic reports, are being replaced with new tabular disclosure reporting daily repurchase activity that will be filed as an exhibit to either Form 10-Q or Form 10-K (for the fourth fiscal quarter). The new table must be formatted as specified in Item 601(b)(26) of Regulation S-K and XBRL tagged (the “New Repurchase Table”). See Exhibit A below for a copy of the mandated New Repurchase Table. As shown therein, companies are required to disclose the following for each date on which purchases occurred during the applicable quarter:

- The class of shares purchased;

- The total number of shares purchased, including, in a separate column to the table, the total number of shares purchased as part of publicly announced buyback plans or programs;

- The average price paid per share, excluding brokerage commissions and other costs;

- The remaining buyback capacity (in shares or dollars) remaining under any publicly announced repurchase plan or program;

- The number of shares purchased in the open market;

- The number of shares purchased that are intended to qualify for the Rule 10b-18 safe harbor;

- The number of shares purchased that are that are intended to satisfy the affirmative defense conditions of Rule 10b5-1(c); and

- By footnote to the table, the date any 10b5-1 plan was adopted or terminated.

The New Repurchase Table must be preceded by a checkbox requiring companies to disclose whether any Section 16 officer or directors purchased or sold shares within four business days before or after the announcement of (i) any new share repurchase plan or program or (ii) an increase in capacity under any existing plan or program. Companies should consider whether to revise their insider trading policy to prohibit insiders from trading within four business days prior to the announcements regarding the company’s share repurchase plans or programs.

New Narrative Disclosure. To compliment the New Repurchase Table, Item 703 of Regulation S-K has been revised and expanded to require companies to provide the following narrative disclosure with respect to share repurchases:

- the objectives or rationales for a company’s share repurchases and the process or criteria used to determine the amount of repurchases; and

- any policies and procedures relating to purchases and sales of the company’s securities by its officers and directors during a repurchase program, including any restrictions on such transactions.

In discussing objectives and rationales for its share repurchases, companies are not expected to reveal any competitive or sensitive information, though the SEC expects companies to convey a thorough understanding of the company’s objectives or rationales for the repurchases and the process or criteria it used in determining the amount of the repurchases. The SEC also warned against using boilerplate language, noting that the new narrative disclosure, in conjunction with the New Repurchase Table, must provide investors with sufficiently detailed information to evaluate a company’s share repurchases using narrative appropriately tailored to a company’s particular facts and circumstances.

The SEC, relying on rule commentators, provided a non-exclusive list of example disclosures that issuers should consider discussing to avoid boilerplate language, such as discussing (i) other possible ways to use the funds allocated for the repurchases, including comparing the repurchases with other investment opportunities that would ordinarily be considered by the company (such as capital expenditures and other uses of capital), (ii) the expected impact of the repurchases on the value of remaining shares, (iii) the factors driving the repurchases, including whether their stock is undervalued, prospective internal growth opportunities are economically viable, or the valuation for potential targets is attractive and (iv) the sources of funding for the repurchases, where material, such as, for example, in the case where the source of funding results in tax advantages that would not otherwise be available for repurchases.

Existing disclosure requirements in Item 703 will continue (albeit in narrative rather than tabular or footnote format), including the obligations to disclose:

- The number of shares purchased other than through a publicly announced plan or program, and the nature of the transaction (e.g., whether the purchases were made in open-market transactions, tender offers, in satisfaction of the issuer’s obligations upon exercise of outstanding put options issued by the issuer, or other transactions); and

- Certain information with respect to any existing repurchase plans or programs, including (i) the date it was announced, (ii) the dollar or share amount authorized, (iii) the date of expiration (if any), (iv) whether any plan or program expired during the applicable quarter covered by the periodic report, and (v) whether the company has terminated prior to expiration, or no longer intends to make repurchases under, any plan or program.

New Item 408(d) Disclosure regarding Rule 10b5-1 Plans. The SEC also adopted Item 408(d) of Regulation S-K that will require companies to disclose, including in quarters in which no repurchases occurred, the material terms (other than pricing) of any 10b5-1 plan adopted or terminated by the company, including the date on which the plan was adopted or terminated, the duration of the plan and the aggregate number of shares to be purchased or sold under the plan. If any disclosure required by Item 408(d) overlaps with disclosures required under Item 703 of Regulation S-K, companies can cross-reference to such disclosure to satisfy Item 408(d). This disclosure must be XBRL tagged.

Compliance Dates. Domestic companies are required to comply with the new disclosure and tagging requirements in their periodic reports on Forms 10-Q and 10-K (for the fourth fiscal quarter) beginning with the first filing that covers the first full fiscal quarter that begins on or after October 1, 2023 (for calendar year companies, this means the Form 10-K for the year ended December 31, 2023 filed in 2024).

SEC Adopts Final Rules Requiring New Disclosures Related to Companies’ Share Repurchase Programs

Exhibit A

Issuer Purchases of Equity Securities

Use the checkbox to indicate if any officer or director reporting pursuant to Section 16(a) of the Exchange Act (15 U.S.C. 78p(a)), or for foreign private issuers as defined by Rule 3b-4(c) (§ 240.3b-4(c) of this chapter), any director or member of senior management who would be identified pursuant to Item 1 of Form 20-F (§ 249.220f of this chapter), purchased or sold shares or other units of the class of the issuer’s equity securities that are registered pursuant to section 12 of the Exchange Act and subject of a publicly announced plan or program within four (4) business days before or after the issuer’s announcement of such repurchase plan or program or the announcement of an increase of an existing share repurchase plan or program. ☐