2023 SEC and Corporate Governance Update

Publications - Client Alert | January 3, 2023A number of significant Securities and Exchange Commission (“SEC”) rulemakings and other events took place in 2022 that will impact the 2023 reporting cycle. The following summary is designed to help our clients and friends keep track of the most significant developments and rule changes as they plan for their annual meetings, periodic reporting and corporate governance matters in the coming year.

RECENTLY ADOPTED SEC RULES

Now is the Time to Get Started on New Pay Versus Performance Disclosures

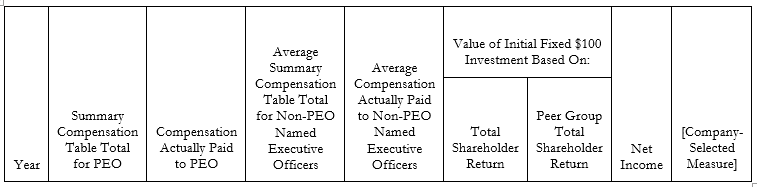

In August 2022 the SEC adopted final rules for the long-awaited pay-versus-performance disclosure requirements originally proposed in April 2015 in compliance with the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the SEC reopened the comment period for the proposed rules in January 2022). New Item 402(v) of Regulation S-K will require public companies to provide a number of new tabular and other disclosures in their proxy statements, all of which must be tagged in inline XBRL (subject to certain relief for smaller reporting companies). The centerpiece of Item 402(v) is a new “pay-versus-performance” table that will include the following data for the company’s five most recently ended fiscal years in a format specified in the rule:

- total compensation for the company’s principal executive officer (PEO) and the average total compensation for the company’s other named executive officers (NEOs) as reported in the summary compensation table;

- total compensation “actually paid” to the company’s PEO and the average total compensation “actually paid” to the other NEOs, including certain adjustments in value for outstanding equity awards and pension values, among other things;

- total shareholder return (TSR) for the company and the company’s peer group;

- company net income; and

- an additional financial measure (or measures) chosen by the company (each a “company-selected measure”) that, in the company’s assessment, represents the most important financial performance measure(s) (that is not otherwise required to be disclosed in the table) used by the company to link compensation actually paid to executives to company performance.

The new table will include the following headings:

Companies must also provide a “clear description (graphically, narratively, or a combination of the two) of the relationships” between compensation actually paid to their executive officers and each of the performance measures included in the table (TSR, net income and the additional company-selected measure(s)). Companies are also required to include a comparison of the company’s cumulative TSR against the cumulative TSR of its peer group (beyond what is already included in the table). In addition, the new Regulation S-K Item 402(v) requires that companies provide a separate tabular list of three to seven financial performance measures that, in the company’s assessment, represent the most important financial performance measures used by the company to link compensation to performance.

The rules will be applicable to most public companies’ 2023 proxy statements (the new rules apply to disclosures covering fiscal years ending after December 16, 2022) and are subject to initial transitional relief, allowing companies to provide the above tabular disclosure for three years (instead of five years) in the first filing in which it includes this disclosure, with an additional year to be added in each of the next two years. Smaller reporting companies also must comply with the rule, subject to certain scaled disclosure accommodations. Emerging growth companies are not required to comply with the new rule.

What companies should be doing now: The new disclosures require a number of calculations, detailed explanatory footnotes and thoughtful narrative support. Considering the time and effort it takes to produce the existing compensation disclosures (including the CD&A, Summary Compensation Table (SCT) and other compensation tables), the strain on time and resources will be exacerbated by these new rules. For example, for most companies, the most recent year to be presented in the new pay-versus-performance table (i.e., 2022) is not capable of calculation until the SCT is complete and the SCT cannot be completed until the board of directors (or its compensation committee) has certified performance results from 2022. Companies are strongly encouraged to start on their pay-versus-performance disclosures immediately. To do so, we encourage companies to build a team of internal and external resources to “divide and conquer” the new table and supporting disclosure. As this is the first year of mandatory pay-versus-performance disclosure, we are encouraging our clients and friends to focus primarily on creating a standardized, minimal design structure that can be utilized going forward, regardless of the “story” that the financial results may tell year-over-year.

Rule 10b5-1 and Insider Trading Reforms to Require Additional Disclosures

In December 2022 the SEC adopted amendments to Rule 10b5-1 under the Securities Exchange Act of 1934, which, among other things, created new elements that must be satisfied to rely on the affirmative defense against insider trading liability under Rule 10b5-1. Among the new elements are mandatory cooling-off periods of (i) 30 days for all traders other than officers and directors of public companies and (ii) for officers and directors, the later of (a) 90 days following adoption of the plan or (b) two business days following the filing of the Form 10-Q or Form 10-K for the quarter during which the plan was adopted. In a change from the proposed rules, the final rules do not mandate a cooling-off period for issuers. Officers and directors are also required to certify to the company in writing that they are not aware of any material nonpublic information and that they are adopting the plan in good faith and not as part of a plan to evade the prohibition against illegal insider trading. The rule also limits the use of multiple-overlapping Rule 10b5-1 plans for non-issuers and limits the use of single-trade plans to one such plan in any 12-month period for non-issuers. Insiders subject to Section 16 also will be required to indicate by checkbox on Forms 4 and 5 that a reported transaction was made pursuant to a 10b5-1 plan and to disclose the date of adoption of the trading plan.

The rule will also implement additional disclosure obligations regarding companies’ insider trading policies and the adoption of Rule 10b5-1 plans by officers and directors. Pursuant to new Item 408 of Regulation S-K, companies are now required:

- To disclose in their periodic reports any trading plans (whether or not adopted in accordance with Rule 10b5-1) adopted or terminated by management during the previous quarter, including a description of the material terms of the plan and the identity of the officer or director involved. The rule is broad enough that any trading activity by officers and directors may be reportable. The new disclosure is required in Part II, Item 9B of Form 10-K and Part II, Item 5 of Form 10-Q and must be tagged in inline XBRL.

- To state in their annual reports whether it has adopted policies and procedures for directors, officers and employees (i.e., an insider trading policy) that are reasonably designed to promote compliance with insider trading laws (or explain why not) and, if so, to publicly file such policies and procedures as an exhibit to their annual reports on Form 10-K (see Exhibit 19 to Item 601 of Regulation S-K). The new disclosure must be tagged in inline XBRL.

The SEC also adopted a new Item 402(x) of Regulation S-K, requiring companies to provide narrative disclosure in their proxy statements regarding the company’s policies and practices regarding the timing of option and option-like grants, including how the board determines when to grant options, whether and how material nonpublic information is taken into account when timing grants and whether the company has timed disclosure of material nonpublic information for the purpose of affecting executive compensation. Companies will also be required to report in their proxy statements any option awards beginning four business days before the filing of a periodic report or the filing or furnishing of a current report on Form 8-K that discloses material nonpublic information, including earnings information (other than a Form 8-K that discloses a material new option award grant under Item 5.02(e)), and ending one business day after a triggering event. The new disclosure must be in tabular format and tagged in inline XBRL.

Finally, starting February 27, 2023, bona fide gift transactions will be reportable on Form 4 within two business days of the transaction like other transactions reportable on a current basis, rather than on a deferred basis as has been the requirement historically.

The amendments to Rule 10b5-1 will be effective 60 days following publication of the adopting release in the federal register. The amendments requiring new periodic report and proxy statement disclosures will be required for filings that cover the first full fiscal period that begins on or after April 1, 2023, except that the applicable date for smaller reporting companies is October 1, 2023. For calendar year-end companies, the new 10b5-1 disclosures required to be made in periodic reports will first apply to the Form 10-Q for the period ending June 30, 2023.

What companies should be doing now: Companies are encouraged to review and revise their insider trading policies now to (i) confirm compliance with the new rules and (ii) tend to any other necessary “housekeeping” within their policies before their insider trading policies are required to be disclosed publicly. For example, this may include a full review of your policy to make sure it is in line with emerging practices, as well as an audit of the practices and procedures under your policy to confirm they are operating efficiently and “are reasonably designed to promote compliance with insider trading laws.” It may also be a good time to refresh your insiders’ recollection of insider trading laws and your existing policy, educating them on how to stay out of trouble. Compliance with insider trading laws should be an annual, continuing education opportunity for your insiders, but this has been especially true in recent years with turnover in the C-suite resulting from COVID’s “Great Resignation.” Companies should also start educating their Section 16 insiders that gifts will be reported on a current basis starting February 27, 2023. If your current practice is to report gifts on a delayed basis on Form 5 or the next required Form 4, then we encourage early adoption of the requirement to report gifts within two business days as a means to form good habits in advance of the mandatory filing date.

Dodd-Frank Era Clawback Rules Re-Opened and Adopted

In October 2022 the SEC adopted clawback rules mandated by the Dodd-Frank Act that will require listed companies to adopt and publicly disclose Dodd-Frank-compliant clawback policies. The rules were originally proposed in 2015 and reopened for comment in 2021. New Rule 10D-1 requires the national securities exchanges to establish listing standards requiring companies to adopt, enforce, and disclose policies for the recovery (i.e., clawback) of excess incentive‑based compensation from current and former executive officers in the event of an accounting restatement (including “Big R” and “little r” restatements), regardless of whether the executive was at fault and without regard to any taxes paid or incurred by the executive. The exchanges must propose updated listing standards within 90 days of publication (the rules were published on November 28, 2022) and such standards must become effective no later than one year after publication (i.e., November 28, 2023). As of the date of this alert, no exchange has yet to propose updated listing standards. Once the applicable exchange’s rules are effective, companies will have 60 days to adopt a compliant clawback policy or amend their existing policy to comply with the rules. The rules will apply to all listed companies, including smaller reporting companies and emerging growth companies.

Companies will be required to file their Dodd-Frank-compliant clawback policies as an exhibit to their Form 10-K and include two new check boxes on the 10-K cover page indicating whether the filing contains the correction of an error to previously issued financial statements and whether any of those error corrections involved a restatement that triggered a clawback analysis. Companies will also be required to provide certain proxy statement disclosures if there was a restatement that required a clawback during the last fiscal year or if there was an outstanding balance of unrecovered excess incentive-based compensation relating to a prior restatement. The new cover page change and the proxy disclosures will be required to be tagged with inline XBRL.

What companies should be doing now: We believe companies should have Dodd-Frank-compliant clawback policies “ready to go and on the shelf” by mid-2023. The exact due date to have policies in place will depend on the date of the exchanges’ proposals and ultimate adoption of applicable listing standards. Companies should spend the first half of 2023 reviewing and revising their existing clawback policy (or preparing a new policy) compliant with the new rules that is ready for adoption upon the exchanges’ adoption of final listing rules.

New Universal Proxy Card Rules in Effect for 2023 Annual Meetings

In November 2021 the SEC adopted new rules requiring companies to use universal proxy cards that include all director nominees (including dissident nominees) presented for election in contested elections. In addition, the new rules require registrants to disclose in their proxy statements the deadline for a shareholder to submit nominees to be included in the company’s proxy card for its next annual meeting (similar to the disclosure requirement of the deadline for 14a-8 shareholder proposals). Recently, the SEC has provided additional guidance on this topic, which noted, among other things, that companies may reject dissident nominations for failing to comply with the registrant’s advance notice bylaw requirements.

Moreover, as part of the new rules, the SEC also amended Rule 14a-4(b) to require proxy cards for all director elections to include an “against” option instead of a “withhold authority to vote” option if governing law gives legal effect to a vote against a nominee. The new rule also addresses situations in which applicable state law does not give legal effect to votes cast against a nominee and director elections are governed by a majority voting standard, and requires disclosure of the methods by which votes will be counted.

What companies should be doing now: Reviewing their advance notice bylaws to determine whether amendments are necessary to, at a minimum, address new Rule 14a-19, similar to the way many existing advance notice bylaws make reference to the requirement to comply with Rule 14a-8. If changes are necessary, we advise our clients and friends to be surgical with the changes, as some companies have made overly aggressive changes that have drawn the ire of investors. In addition, companies should ensure their proxy cards reflect the amendments to Rule 14a-4(b).

Registrants Will Be Required to File “Glossy” Annual Reports in 2023

In June 2022 the SEC adopted amendments to its filing rules, requiring electronic filing of “glossy” annual reports in PDF format on EDGAR, whether or not the annual report is posted to the company’s website (the SEC is withdrawing prior guidance that allowed companies to furnish their annual reports by posting them to their corporate websites). Registrants are required to file “glossy” annual reports on EDGAR starting in January 2023. The glossy annual report will be considered “furnished” not “filed” with the SEC.

What companies should be doing now: Companies should be working with their printers to prepare and file their glossy annual reports (including 10-K wraps) during the 2023 proxy season.

Form 144 Filings Electronic Only Starting in April 2023

In addition to the electronic filing requirements for “glossy” annual reports noted above, the amendments adopted in June also require that Form 144 filings must now be submitted electronically through EDGAR starting in April 2023.

What companies should be doing now: Educating their affiliates regarding this change and working with such affiliates’ brokers to confirm processes are in place to comply with the new filing requirement. Many brokers have historically assisted with the filing of Form 144s and new processes and procedures will need to be adopted to confirm ongoing compliance.

NEW RULES PROPOSED IN 2021 AND 2022 THAT REMAIN OUTSTANDING

Proposed Climate Change Rules Drew Multitude of Comments and Scrutiny

In March 2022 the SEC proposed new rules that will impose significant climate change-related disclosure obligations on registrants. After the initial comment period, the SEC reopened the comment period until November 1, 2022. If the rules are adopted as proposed, companies would be required to disclose financial statement metrics; provide data regarding scope 1 and 2 emissions, consisting of their own greenhouse gas (GHG) emissions and how much energy they consume, and potentially provide data regarding scope 3 emissions, consisting of GHG emissions generated by the company’s suppliers and customers; climate-related risks and the impacts of said risks, particularly those likely to have a material impact on the company’s business or financial statements; governance and the oversight of climate-related risks; and climate-related goals and transition plans, including indicating progress toward meeting the company’s goals. While no firm date has been set for adoption, the rules could be adopted as soon as 2023. While companies are expected to receive certain grace periods before being expected to comply with all proposed disclosures, if the rules are adopted as proposed, then companies will need to allot ample time and resources to expand any current tracking efforts to properly and efficiently compile and disclose the requisite information.

Proposed Share Repurchase Disclosure Rules to Require New Standalone Form for Repurchases

In December 2021 the SEC proposed new rules that would require companies to file a new form (Form SR) disclosing the execution of share repurchases before the end of the first business day following the repurchase. In addition, the proposed rules would require further disclosure regarding companies’ objectives and policies with regard to share repurchases and whether a 10b5-1 plan is utilized. On December 7, 2022, the SEC reopened comments on these proposed rules until January 11, 2023.

Proposed Cybersecurity Rules to Require New Form 8-K and Other Periodic Report Disclosures

In March 2022 the SEC proposed new cybersecurity-related disclosure obligations, including requiring current disclosure on Form 8-K of material cybersecurity incidents and discussion in periodic reports of company cybersecurity policies and procedures, the involvement of third-party consultants and board and management oversight of cybersecurity risks. In addition, companies would be required to disclose cybersecurity expertise of any board members. In October 2022 the SEC announced that due to a “technological error” which affected the submission of comments for certain rule proposals, the SEC was re-opening certain proposed rules for comments during the month of October for a two-week period, including the proposed cybersecurity rules. While other proposed rules impacted by the technical glitch have since been adopted (e.g., the 10b5-1 and clawback rules discussed above), the SEC has not yet adopted the proposed cybersecurity rules, but we expect them to be on the SEC’s rulemaking agenda in 2023.

ADDITIONAL CORPORATE DEVELOPMENTS TO KEEP IN MIND

Delaware General Corporation Law Amended to Provide Additional Officer Exculpation

In August 2022 the Delaware General Corporation Law was amended to allow corporations to further limit the liability of officers for breaches of the duty of care by including a provision in the corporation’s certificate of incorporation. Previously, this exculpation authority was available only to the corporation’s directors. Accordingly, there has been much discussion in the public company space as to whether companies should submit proposals for charter amendments to take advantage of the new exculpation provisions at their next annual meeting. ISS has noted that it will vote on proposals adopting additional officer exculpation provisions on a case-by-case basis considering the stated rationale for the proposed change. To date there have been very few proposals adopting additional officer exculpation provisions and many companies appear to be taking a “wait and see” approach.

Reminder that Say-on-Frequency Vote Might Be Required in 2023

Beginning on January 21, 2011, Rule 14a-21(b) under the Securities Exchange Act of 1934 required public companies to conduct an advisory vote every six years on the frequency of “say-on-pay” votes. Many companies held the first and second say-on-frequency votes in 2011 and 2017, respectively, in which case companies will be required to conduct a say-on-frequency vote again in 2023. In the say-on-frequency proposal, companies will need to ask their shareholders if the say-on-pay vote should occur every one, two, or three years, even if the company is already conducting its say-on-pay vote annually and intends to continue doing so. The related Item 5.07 Form 8-K for reporting voting results must be filed within four days following the annual meeting and disclose both the results of the say-on-frequency vote, including the number of abstentions, and the frequency with which the companies intend to conduct the say-on-pay vote in light of the results of the say-on-frequency vote.

Consider Updating Risk Factors in Light of Economic Conditions

Consider updating your company’s risk factors in the upcoming Form 10-K to properly address contemporary risks such as inflation, rising interest rates, recession concerns, heightened job market competition, supply chain constraints, and other global matters such as the ongoing Russian conflict in Ukraine. As a reminder, Item 105 of Regulation S-K requires registrants to disclose a discussion of the material factors that make an investment in the registrant speculative or risky and it is recommended that registrants provide risk disclosures specifically tailored to the registrant rather than including generic risks that may apply to any registrant. Finally, be mindful of the length of your risk factors as you review. If they are longer than 15 pages, Item 105(b) of Regulation S-K requires the 10-K to include “a series of concise, bulleted or numbered statements” that is no more than two pages long that summarizes the risk factors.

ESG Matters Remain at the Forefront of Proxy Advisors and Institutional Investor Agendas

ESG matters continue to be front and center for proxy advisory firms and large institutional investors, with increasing demand for more thorough and meaningful disclosure. This proxy season companies should take a fresh look at their internal ESG practices and current disclosures, focusing on company-specific ESG risks and the company’s current ESG oversight policies and processes in order to ensure that the company is not lagging behind its peer group or similarly situated companies or failing to address any recent initiatives.

Nasdaq Board Diversity Regulations Enter Second Year

In August 2021 the SEC approved Nasdaq’s proposed rules regarding disclosure of board diversity. The rules require Nasdaq-listed companies to (i) disclose either in their proxy statement or on the company website board- level diversity statistics using a standard template and (ii) have (or disclose why they do not have) at least two diverse directors on their board. The board diversity matrix disclosure is required to be included in listed-companies’ proxy statements this year, including both initial and current year diversity statistics.

As a reminder, the requirement to have at least two diverse directors (or provide explanation why not) is being phased in over time, with listed companies being required to have at least one diverse director by August 7, 2023 and two diverse directors by August 6, 2025. In December 2022 the SEC amended the diverse director compliance dates from August 7, 2023 and August 6, 2025 to December 31, 2023 and December 31, 2025, respectively, in order to align the compliance dates with the end of the fiscal year for most companies. Beyond Nasdaq, large institutional investors such as BlackRock and State Street as well as proxy advisory firms like ISS and Glass Lewis have recently adopted policies encouraging board diversity, threatening to withhold votes or vote against board leaders of companies not meeting certain diversity goals.

Don’t Forget About SEC E-Signature Rules Adopted in 2020

In November 2020 the SEC adopted amendments to permit the use of electronic signatures in many documents filed with EDGAR, so long as (i) the signatory first manually signs a document attesting that he or she understands the effect of the electronic signature; and (ii) certain procedural requirements are met, including identity authentication, timestamping, non-repudiation of the signature, and inclusion of the signature on the signature page or document being signed. If your company utilizes electronic signatures for SEC documents, be sure to confirm that all the necessary attestations have been obtained and that third-party providers are complying with the new procedural requirements.

ADDITIONAL INFORMATION

This legal update is merely a high-level summary of the developments discussed herein as of January 2, 2023 and does not purport to be a complete discussion of each of the noted rule changes. Complying with the SEC rules and regulations is a complex task within an ever-changing environment. If you have questions about the rules discussed above, please contact your Kutak Rock attorney or one of the authors listed below.