Elective Pay for Clean Energy Tax Credits – Opportunities for Non-Profits, States, Tribes and Local Governments to Take Advantage of Clean Energy Tax Credits

Publications - Client Alert | June 16, 2023On June 14, the IRS released guidance under the Inflation Reduction Act of 2022 that will allow state and local governments, non-profits, tribal governments, native Alaska corporations, and others to be paid cash directly to undertake clean energy projects.

Under the IRA’s elective pay provisions, “applicable entities” (defined below), including tax-exempt and governmental entities that would otherwise be unable to claim renewable energy credits because they do not pay federal income tax, can now benefit from certain clean energy tax credits by treating the amount of the credit as a payment of tax and a cash refund resulting from a decreased overpayment of tax.

For example, as a result of the IRA, a state or local government or non-profit that makes a clean energy investment (e.g., installs solar panels) that qualifies for the investment tax credit can file an annual tax return (via Form 990-T) with the IRS to claim “elective pay” for the full value of the investment tax credit, provided the investment meets all of the requirements guidance set forth in the guidance, including a pre-filing registration requirement. As the state or local government or non-profit would not owe other federal income tax, the IRS would then make a cash refund payment in the amount of the credit to the local government or non-profit.

“Applicable entities” that can use the elective pay include tax-exempt organizations, States and their political subdivisions, tribal governments, Alaska Native Corporations, the Tennessee Valley Authority, rural electric co-operatives, U.S. territories and their political subdivisions, and agencies and instrumentalities of state, local, tribal, and U.S. territorial governments (see additional details below).

The applicable entity or electing taxpayer generally must own the property that generates the eligible credit (or otherwise conduct the activities giving rise to the underlying eligible credit). That ownership can occur through various structures. For example, an applicable entity or electing taxpayer could directly own the property, could own it through a disregarded entity, or could own an undivided interest in an ownership arrangement treated as a tenancy-in-common or pursuant to a joint operating arrangement that has properly elected out of subchapter K of chapter 1 of the Code under section 761.

Partners of partnerships are not allowed to use elective pay. A partnership, even if all the partners are applicable entities, is not an applicable entity. A partnership, however, can make the elective pay election if it qualifies as an electing taxpayer with respect to the section 45Q credit, the section 45V credit, or the section 45X credit.

The elective payment election will be made on the entities’ annual tax return in the manner prescribed by the IRS, along with any form required to claim the relevant tax credit, a completed Form 3800, and any additional information, including supporting calculations.

Applicable credits for the elective payment include:1

- Energy Credit (48), (Form 3468, Part VI)

- Clean Electricity Investment Credit (48E), (Form 3468, Part V)

- Renewable Electricity Production Credit (45), (Form 8835, Part II)

- Clean Electricity Production Credit (45Y)

- Commercial Clean Vehicle Credit (45W), (Form 8936, Part V)

- Zero-emission Nuclear Power Production Credit (45U), (Form 7213, Part II)

- Advanced Manufacturing Production Credit (45X), (Form 7207)

- Clean Hydrogen Production Credit (45V), (Form 7210)

- Clean Fuel Production Credit (45Z)

- Carbon Oxide Sequestration Credit (45Q), (Form 8933)

- Credit for Alternative Fuel Vehicle Refueling / Recharging Property (30C), (Part 8911, Part II)

- Qualifying Advanced Energy Project Credit (48C), (Form 3468, Part III)

What is the pre-filing registration process?

Later in 2023 the IRS will set up the pre-filing registration process which is a required electronic process for all entities that intend to make an elective payment election (or those that intend to make a credit transfer). It is designed to expedite the processing of returns and prevent improper payments.

- As part of the pre-filing registration process, entities will need to list all applicable credits it intends to claim on its income tax return or Form 990-T and each applicable credit property that contributed (or will contribute) to the determination of such credits. Entities will also need to provide any other specific information required.

- More information about the pre-filing registration process will be available when the IRS provides more information later in 2023.

- After completing the pre-filing registration process, the IRS will review the information provided and will issue a separate registration number for each applicable credit property for which the applicable entity or electing taxpayer provided sufficient verifiable information.

- A registration number does not confirm credit eligibility. Pre-filing registration provides the IRS with information that helps ensure the prompt processing of the election and payment after a tax return is filed. Entities must still establish eligibility for the credit on the applicable tax return before the IRS will issue payment.

IRS Links

Temporary regulations, providing rules that relate to a mandatory IRS pre-filing registration process, will be through an electronic portal. The pre-filing registration process must be completed, and a registration number received, prior to making an elective payment election or an election to transfer eligible credits.

The process also applies prior to making an elective payment election related to advanced manufacturing investment credit amounts under the CHIPS Act of 2022. Proposed regulations were also issued on June 14 describing other issues related to the advanced manufacturing investment credit.

Background -- Tax Incentives for Carbon Free Power

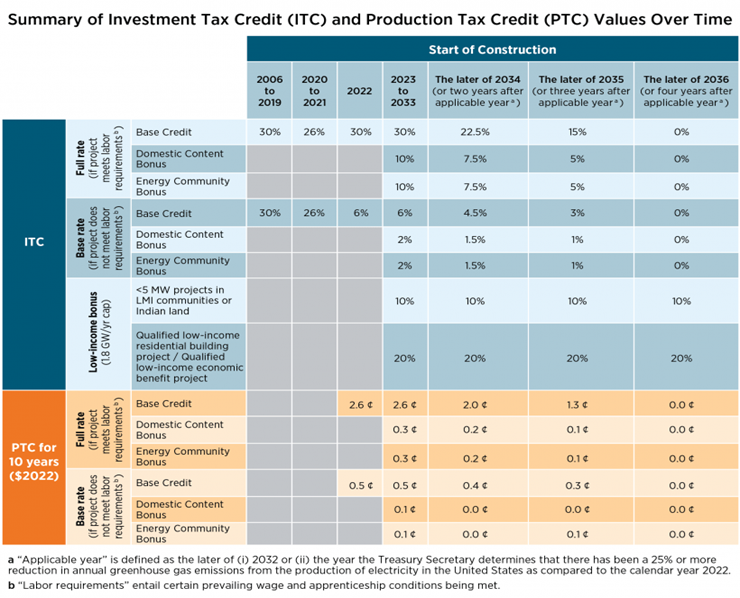

ITCs provide an “eligible entity” with a tax credit or a tax-exempt entity with a direct payment for a specified percentage of capital expenditures for qualifying energy projects. ITCs are investment-based, and provide upfront financial support for the construction of a project that is expected to deliver a specified good or service in the future. The ITC depends on the capital investment, which is the amount it costs to place the project into service. An ITC generally applies to new equipment—businesses can claim an ITC in the year it is placed into service. Projects can then spread ITC benefits over multiple years by “carrying forward” the unused amount. The tax credit rate and other credit parameters depend on the type of property or technology for which the credit is being claimed.

Production Tax Credits and Direct Pay – Power Output Incentives

A production tax credit (PTC) gives a taxpaying entity a tax credit for power output in terms of a fixed dollar amount per unit of output. A PTC is only paid out when the intended product (e.g., clean energy generation) is delivered. Unlike ITCs, PTCs require the taxpayer to sell electricity to an unrelated third party and excludes utility companies that are not investor-owned. Section 13701 of the IRA added new § 45Y, the clean electricity production credit, to provide a tax credit for electricity produced by the taxpayer at a qualified facility and is either (1) sold by the taxpayer to an unrelated person during the taxable year, or (2) in the case of a qualified facility which is equipped with a metering device which is owned and operated by an unrelated person, sold, consumed, or stored by the taxpayer during the taxable year. For the application of PTCs, a facility will be considered a qualified facility for a period of 10 years beginning on the date it is placed in service.

Note that both credits phase out over time and can include variable payments as identified in the chart.

Eligibility

The IRS included a question and answer section that provides in-depth answers to many questions on the process and eligibility. Some are repeated below and all can be found at the Internal Revenue Service frequently asked questions.

What tax-exempt organizations are eligible?

Organizations that are exempt from tax by § 501(a) are eligible for elective pay. This would include all organizations described in § 501(c), such as public charities, private foundations, social welfare organizations, labor organizations, business leagues, and others. It also includes religious or apostolic organizations under § 501(d).

What state, local, political subdivisions and US territories are eligible?

States, political subdivisions, and their agencies and instrumentalities are all eligible for elective pay. This includes the District of Columbia. It also includes cities, counties, and other political subdivisions. Water districts, school districts, economic development agencies, and public universities and hospitals that are agencies and instrumentalities of states or political subdivisions are also included. U.S. territory governments, their political subdivisions, and their agencies and instrumentalities are eligible for elective payment.

What Indian tribal governments or tribal tax-exempt entities or Alaska Native Corporations are eligible are eligible?

An Indian tribal government, political subdivision thereof, or any agency or instrumentality of a Tribal government or political subdivision is eligible for elective pay. For this purpose, the term “Indian tribal government” means the recognized governing body of any Indian or Alaska Native tribe, band, nation, pueblo, village, community, component band, or component reservation, individually identified (including parenthetically) in the most recent list published by the Department of the Interior published in the Federal Register under the Federally Recognized Indian Tribe List Act of 1994.

Tribal entities are also eligible to the extent they are described in § 501(a).

Any Alaska Native Corporation (as defined in section 3 of the Alaska Native Claims Settlement Act (43 U.S.C. 1602(m)) is eligible, meaning any Regional Corporation, any Village Corporation, any Urban Corporation, and any Group Corporation, which is organized under the laws of the State of Alaska.

What rural electric cooperatives are eligible?

Any corporation operating on a cooperative basis that is engaged in furnishing electric energy is eligible. A rural electric cooperative’s use of elective pay does not affect the 85% income test of a tax-exempt electric cooperative.

Tax-exempt rural electric cooperatives are eligible to use elective pay for all the 12 credits listed above. Those that are not tax-exempt may use elective pay for each of the credits listed except for the Commercial Clean Vehicles credit (45W).

What types of businesses are eligible? What is an electing taxpayer?

Generally, only “applicable entities” are eligible for elective pay. There are special rules, however, for three of the clean energy tax credits. Specifically, other taxpayers that are not “applicable entities” may make an election to be treated as an applicable entity for elective pay with respect to applicable credit property giving rise to (1) the section 45Q credit (credit for carbon oxide sequestration), (2) the section 45V credit (credit for production of clean hydrogen), or (3) the section 45X credit (advanced manufacturing production credit). There are additional rules if the taxpayer is a partnership or S Corporation.

For up-to-date information and guidance on the clean energy tax credits available under the Inflation Reduction Act of 2022 applicable to elective pay, please visit IRS.gov/cleanenergy. A brief description of each of the applicable credits is also available at Publication 5817-G.

What is the effect of making an elective payment election?

An applicable entity that makes an elective payment election is treated as having made a payment against federal income taxes for the taxable year with respect to which an applicable credit was determined, in the amount of such credit. For example, if an applicable entity has any remaining federal income tax liability, then the amount of the credit first offsets that tax liability and the rest is refunded to the applicable entity. If the applicable entity has no federal income tax liability, the applicable entity’s refund will be equal to the full amount of the applicable credit.

When does the applicable entity receive payment if it uses elective pay?

In general, payments occur after the tax return is processed (assuming requirements are met). Under the statute, the taxpayer is not entitled to the elective payment until the due date of the return, even if the taxpayer files the return before that date.

At what stage of development, construction, or operations are projects eligible for elective pay?

Elective pay is only available after an applicable credit is earned and able to be claimed on the relevant annual tax return. In general, a tax credit is earned during the taxable year the applicable credit property is placed in service (investment tax credits) or eligible production occurs (production tax credits).

1 In general, an applicable entity can use elective pay with respect to these 12 credits if it meets the tax credit’s underlying requirements. There are placed in service date restrictions for sections 45, 45Q, and 45V. Further, elective pay for the Commercial Clean Vehicle Credit (45W) is only available to an organization exempt from the tax imposed by subtitle A by reason of section 501(a) of the Code; a State, the District of Columbia, a political subdivision thereof, or any agency or instrumentality of any of the foregoing; a U.S. territory, a political subdivision thereof, or any agency or instrumentality of any of the foregoing; or an Indian tribal government, a subdivision thereof, or any agency or instrumentality of any of the foregoing. Please see Q9 and Q10 for additional limitations. An electing entity can only make the elective pay election with respect to the section 45V, 45Q, or 45X credit.