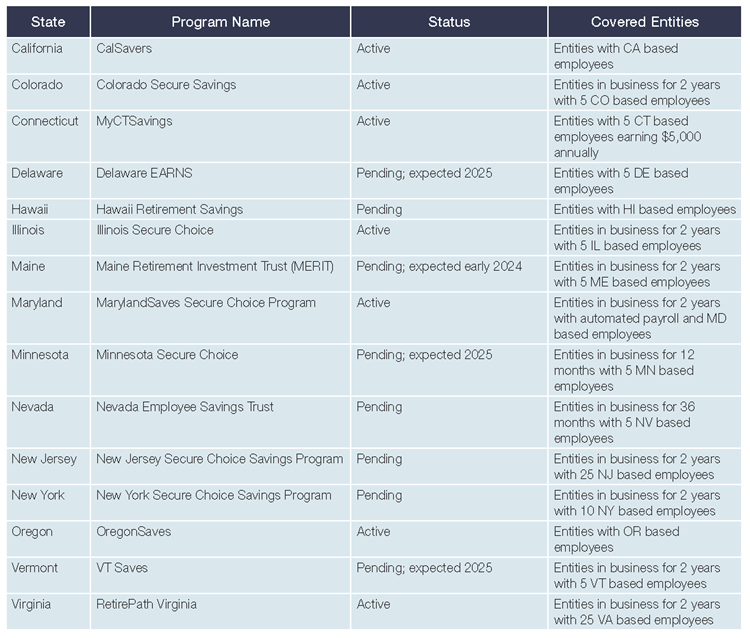

State-Mandated Retirement Programs

Publications - Newsletter | April 11, 2024Click here to download a .png file of this chart.

A growing number of states are requiring certain entities to enroll employees in a retirement program managed by the state. These programs typically consist of automatic enrollment payroll deduction individual retirement accounts (“IRAs”). The chart below outlines the current state mandated retirement programs, the status of each program, and the types of entities subject to each program.

Covered entities that sponsor a separate retirement plan (such as a 401(k) plan or a SIMPLE IRA) are generally exempt from these state-mandated retirement programs. However, registration and exemption requirements often still apply. If you are required to enroll your employees in a state-mandated retirement program and fail to comply, penalties may be imposed.

If you would like assistance navigating this developing area of retirement law and how it applies to your business, please contact a member of our Employee Benefits and Executive Compensation Group.