Raising Capital for Your Start-Up

Publications - Newsletter | November 4, 2022Raising capital is a precarious process navigated by many start-ups. This article gives an overview of capital-raising structures, available securities exemptions, and some of the pitfalls to avoid in the process.

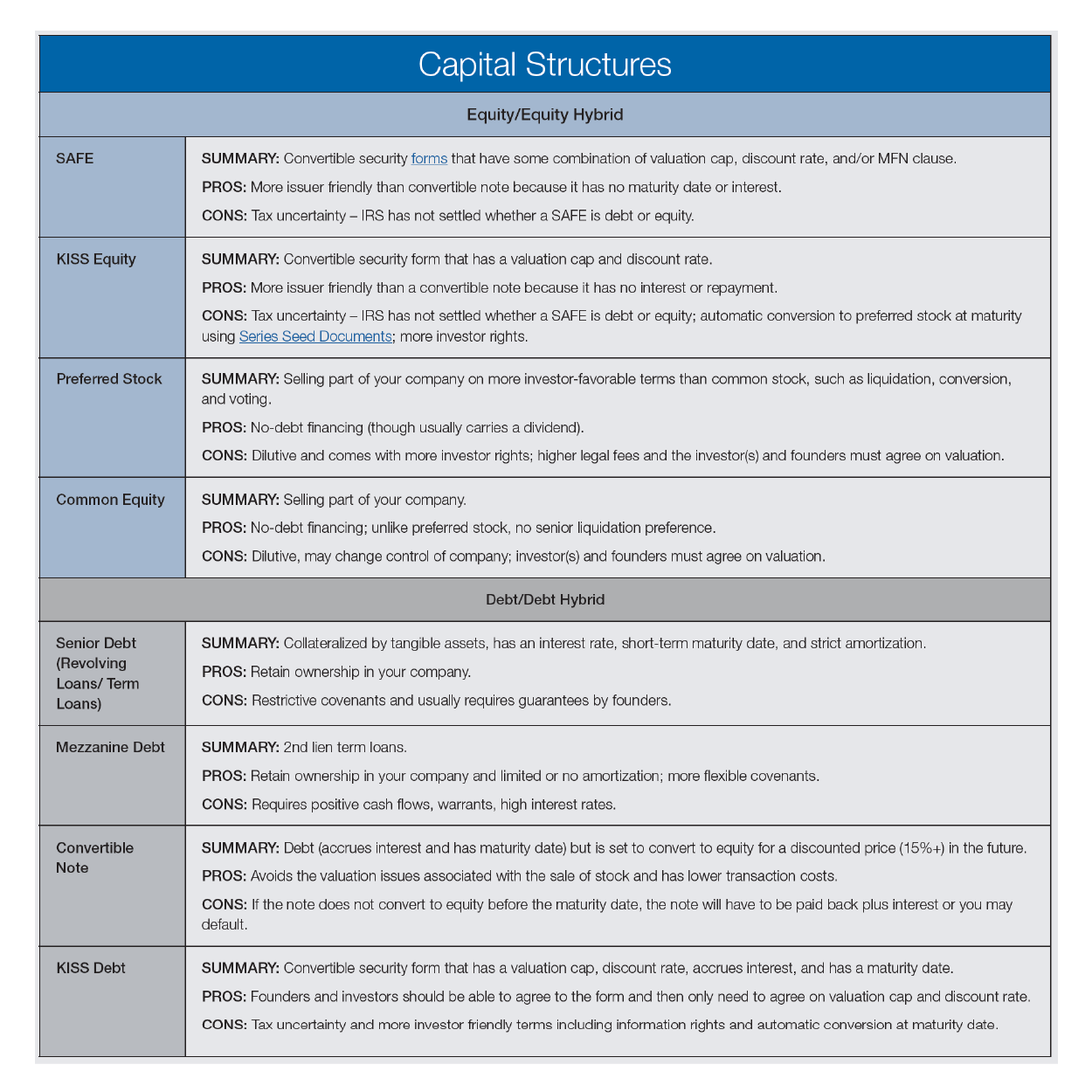

The following chart summarizes the most common capital structures. Be aware that there are tax and securities consequences for all options, and we encourage you to engage experienced legal counsel along with accounting and tax assistance.

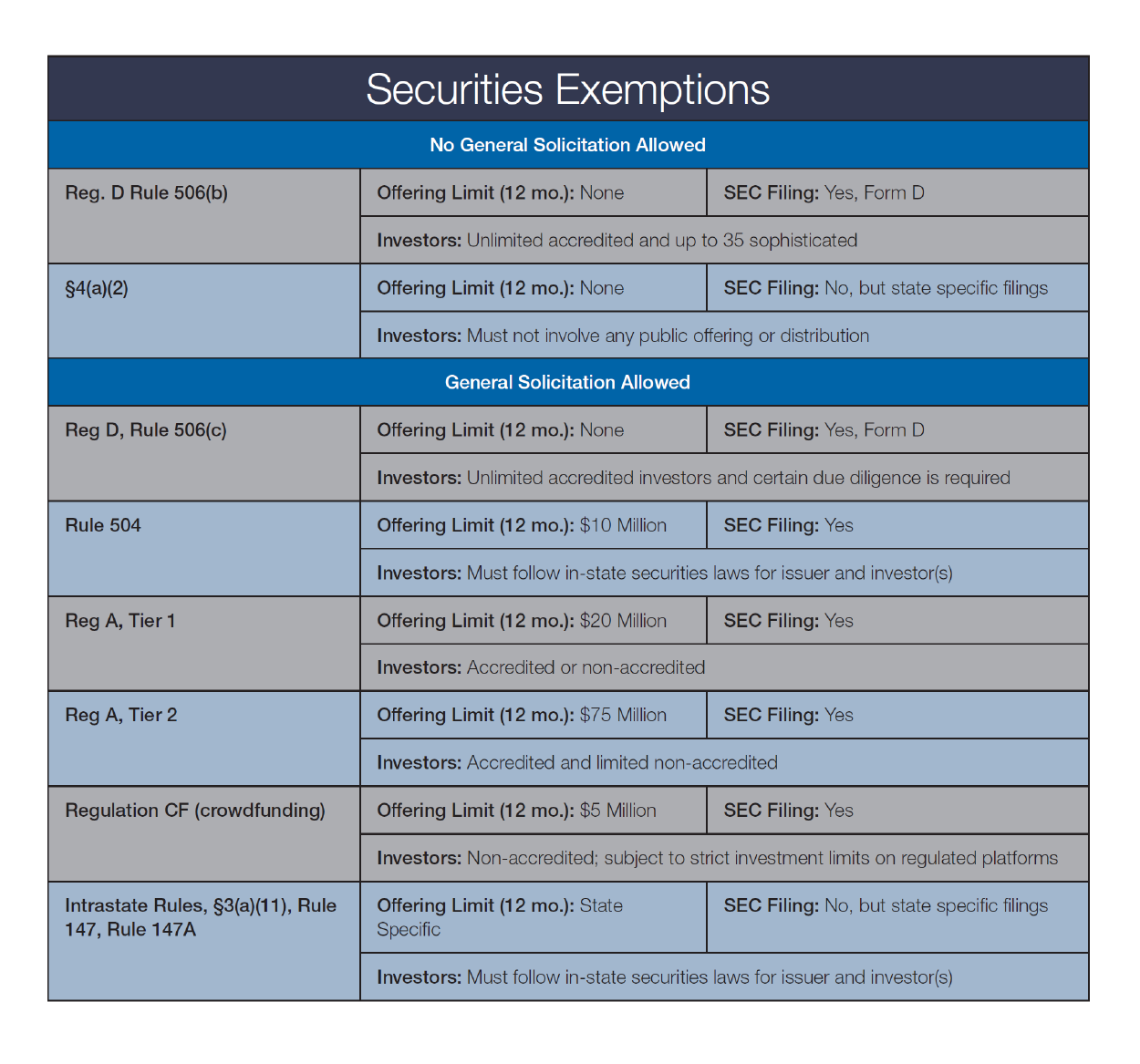

Selling stock or some debt instruments will implicate state and federal securities laws. The following chart summarizes the most common securities exemptions.

Some of the most common pitfalls are the failure to consider tax and securities consequences, giving up board control, agreeing to a non-dilution clause, saddling the start-up with debt without a clean exit, or agreeing to an investor’s modification of standard forms without seeking legal advice.

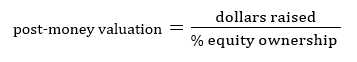

A word on valuation: You may have heard the terms “pre-money” and “post-money” valuation. Here is a simple formula:

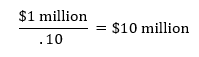

So, if you raise $1 million for your business, and the investor receives 10% of the stock in your company the “post-money valuation” is as follows:

The “pre-money” valuation is simply the “post-money” valuation minus the dollars raised, or in this case, $10 million - $1 million = $9 million.

If you have questions, please contact a member of Kutak Rock’s Scottsdale Corporate & Securities Practice Group.