FTC Announces Hart-Scott-Rodino Thresholds for 2026

Publications - Client Alert | January 21, 2026Click here to view a PDF version of this client alert.

The Federal Trade Commission (FTC) has announced the following annual adjustments of the Hart-Scott-Rodino (HSR) filing thresholds (15 USC § 18a, Clayton Act § 7A) for stock and asset acquisitions, mergers, consolidations, joint ventures and similar transactions. The new thresholds will become effective February 17, 2026.

- All transactions valued at not more than $133.9 million will be exempt from all HSR filing and waiting period requirements (assuming no prior or related transactions between the parties or their affiliates); an increase from last year’s $126.4 million threshold.

- All transactions valued at $535.5 million and over, not otherwise exempt under one of the many substantive HSR exemptions, will require a pre-acquisition filing and will need to observe the 30-day waiting period requirement (subject to possible early termination.

- Most (non-exempt) transactions valued between $133.9 million and $535.5 million will likely require a filing based on satisfaction of the “size-of-the-person” test (with size-of-the-person thresholds being adjusted to $26.8 million and $267.8 million).

- The maximum daily civil penalty amount for HSR violations currently is $53,088 per day but is expected to increase by about $1,500 (commensurate with a cost-of-living adjustment) once updated by the FTC and published in the Federal Register.

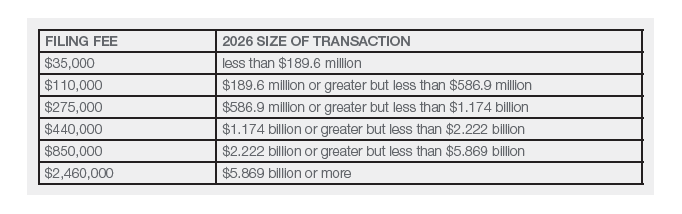

Below is the adjusted HSR filing fee structure that also will go into place with the new filing thresholds:

The FTC also announced increases to the thresholds relevant under Section 8 of the Clayton Act, which prohibits certain interlocking directorate (e.g., one person from serving as a director or officer of two competing corporations). Under the new Section 8 thresholds (which became effective on January 16, 2026), competitor corporations are covered by Section 8 if each one has capital, surplus, and undivided profits aggregating more than $54,402,000, with the exception that no corporation is covered if the competitive sales of either corporation are less than $5,440,200.

NEW HSR RULES: Changes to the HSR Form and Instructions went into effect on February 10, 2025, significantly increasing the time and burden on companies by requiring much more detail in merger filings. Under the new rules, we suggest that transaction counsel actively involve HSR counsel in the preparation of filings at least 60 to 90 days before the target closing date (and perhaps more if the target date is critical or inflexible).

The Kutak Rock antitrust team has longstanding experience and expertise in HSR pre-merger filings. In addition to preparing the necessary HSR filing documents and communicating with the FTC and DoJ, we also analyze transactions to determine if they are exempt from the HSR filing requirements, counsel on pre-closing restrictions concerning the operations of the acquired entity and advise on structuring transactions to avoid or minimize both potential antitrust problems and costly second requests.

If you have an upcoming merger, consolidation, stock purchase or asset acquisition, please give us a call.