CARES Act: Federal Reserve Expands, Clarifies Main Street Lending Program

Publications - Client Alert | April 30, 2020The Federal Reserve has opened up a key lending program to larger businesses, and those with higher debt levels. On April 30, 2020, the Federal Reserve Board (“Federal Reserve”) announced expansion of the scope and eligibility for the Main Street Lending Program which was established by certain funds appropriated by the Coronavirus Aid, Relief, and Economic Security Act (see our special publication, CARES Act: The Launch of the Main Street Lending Program). As part of its broad effort to support the economy, the Federal Reserve developed the Main Street Lending Program to help credit flow to small and medium-sized businesses that were in sound financial condition before the pandemic.

When the initial terms of Main Street Lending Program were announced April 9, 2020, the Federal Reserve indicated that, because the financial needs of businesses vary widely, it was seeking feedback from the public on potential refinements. Over 2,200 letters from individuals, businesses, and nonprofits were received by the Federal Reserve. In response to the public input, the Federal Reserve decided to expand the loan options available to businesses and increased the maximum size of businesses eligible for support under the program.

The changes include:

- Creation of a third loan option—the “Main Street Priority Loan Facility”—with increased risk sharing by lenders for borrowers with greater leverage;

- Clarification of the definition of an eligible borrower, which now includes an “ineligible business” concept that leverages guidance released under the Paycheck Protection Program (“PPP”) in April 2020;

- Clarification that EBITDA means “adjusted EBITDA” and providing the methodology to calculate adjusted 2019 EBITDA for purposes of calculating maximum loan size;

- Expansion of the eligibility threshold to allow up to 15,000 employees or $5 billion in revenue (from previous limitation of 10,000 employees or $2.5 billion in revenue);

- Lowering the minimum loan size for certain loans to $500,000; and

- Various other changes to the terms of the loans available under the different Main Street Lending Program facilities (e.g., using LIBOR instead of SOFR as the index on the loans)

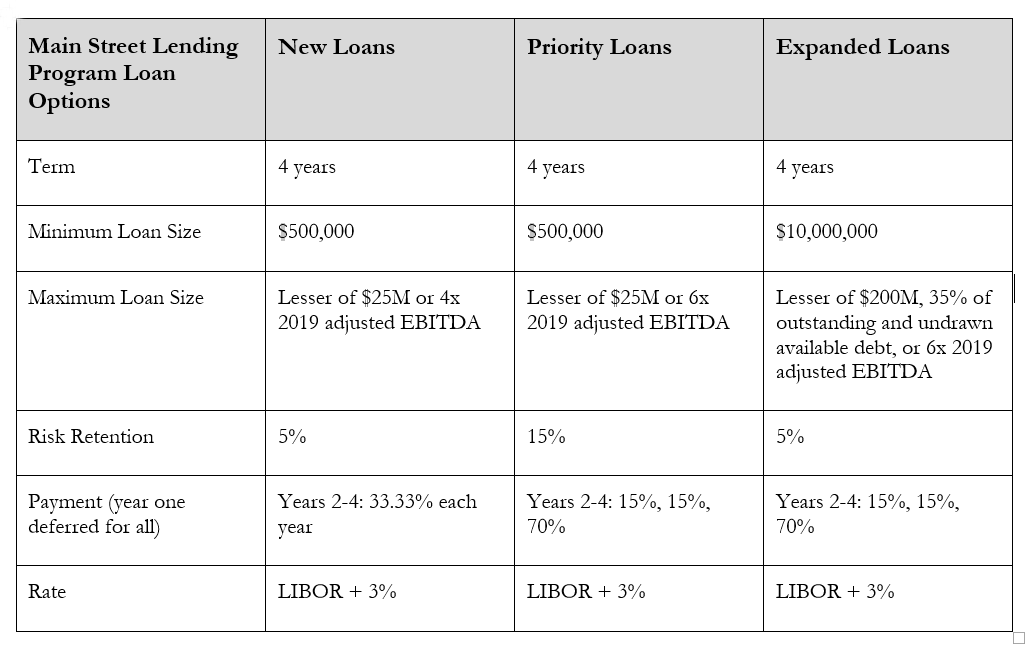

Under the new Main Street Priority Loan Facility option, lenders would retain a 15% share on loans that, when added to existing debt, do not exceed six times a borrower’s income, adjusted for interest payments, taxes, and depreciation and other appropriate adjustments. In total, three loan options—termed “new”, “priority”, and “expanded”—will be available for businesses. The Federal Reserve said the changes will “offer more options to a wider set of eligible small and medium-size businesses.”

The chart below summarizes the different loan options.

This publication summarizes key takeaways from today’s announcement from the Federal Reserve on the Main Street Lending Program and is not meant to be comprehensive. A more specific publication will follow on the details of the new term sheets and the FAQs.

Kutak Rock - CARES Act: Federal Reserve Expands, Clarifies Main Street Lending Program