CARES Act: The Launch of the Main Street Lending Program

Publications - Client Alert | April 11, 2020Businesses of all sizes need liquidity due to the impact of the COVID-19 pandemic. Until now, COVID-19 relief programs targeted either large or small businesses, leaving companies in the middle without much federal relief. On April 9, 2020, the Federal Reserve Board (the “Federal Reserve”) announced the establishment of the Main Street Lending Program supported by certain Treasury Department (“Treasury”) funding authorized by Section 4003(b)(4) of the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”).1 While it is expected that Treasury and the Federal Reserve, as well as participating banks, will provide additional guidance in the coming weeks, this alert summarizes the term sheets published by the Federal Reserve on April 9, 2020, and examines the practical implications on potential borrowers and lenders seeking to participate in the Main Street Lending Program.2

The Main Street Lending Program consists of a combination of two separate facilities to support lending to mid-sized businesses:

- The “Main Street New Loan Facility,” which will purchase 95% participation interests in loans originated on or after April 8, 2020, by banks and savings and loans (including their holding companies) to U.S. borrowers.

- The “Main Street Expanded Loan Facility,” which will also purchase 95% participation interests in loans originated by banks and savings and loans (including their holding companies), but is limited to the “upsized tranche” (i.e., increased funding) provided for loans outstanding on April 8, 2020.

- Term sheets for both programs can be found here (for the Main Street New Loan Facility) and here (for the Main Street Expanded Loan Facility).

Under both facilities, the Federal Reserve will lend funds on a recourse basis to a single special purchase vehicle (the “SPV”) that will be capitalized by $75 billion of equity capital from Treasury. The SPV will use the proceeds of Treasury equity capital and loans made from the Federal Reserve to purchase up to $600 billion of 95% participations in eligible loans from eligible lenders. The lenders will retain 5% of each loan. The SPV will purchase participations until September 30, 2020, unless the Federal Reserve and Treasury extend the Main Street New Loan Facility and the Main Street Expanded Loan Facility.

The Main Street Lending Program incorporates a number of features that differentiates it from other relief programs established by the Federal Reserve or by the CARES Act. The program’s structure is unlike any other existing federal relief program and will leverage United States (“U.S.”) banks to originate eligible loans in which the Federal Reserve (through the SPV) will immediately acquire a 95% interest. The Main Street Lending Program is also noteworthy as it is the first broad-based Federal Reserve relief program that will impose significant restrictions on compensation, stock repurchases, and dividends.

Primarily, the loans will be designed to be direct loans—made by the financial institution to the borrower.

THE MAIN STREET LENDING PROGRAM

- Eligible Borrowers: Eligible borrowers under the Main Street Lending Program are businesses (including nonprofits) with up to 10,000 employees or up to $2.5 billion in 2019 annual revenues. This means that businesses with more than 10,000 employees are still eligible as long as they had less than $2.5 billion in 2019 annual revenues; conversely, businesses that exceed the revenue limit are still eligible if they have fewer than 10,000 employees.3 Each eligible borrower must be a business that is created or organized in the U.S. or under the laws of the U.S. with significant operations in and a majority of its employees based in the U.S. A few key notes on borrower eligibility:

- Standard Underwriting. As opposed to the Paycheck Protection Program (“PPP”), the Federal Reserve said that this program is available for businesses that were in good financial standing before the crisis, and lenders will be expected to use customary underwriting standards to ensure that these loans are prudently incurred and are not provided to insolvent entities or a debtor in a bankruptcy proceeding.

- Available to PPP Recipients. Businesses that have taken advantage of the PPP are not prohibited from participating in the Main Street Lending Program.

- Option for Businesses Excluded from PPP. All businesses with up to 10,000 employees are eligible, including businesses with 500 or fewer employees. Notably, this program may be an option for private equity or venture capital-backed businesses (or other businesses) that may have otherwise been excluded from qualifying for PPP loans due to the Small Business Administration’s (“SBA”) “affiliation” rules as to employee head count.

- Restrictions on Participation in Other Relief Programs. The business must not also participate in the Primary Market Corporate Credit Facility announced by the Federal Reserve on April 9, 2020. Businesses may only participate in one of the two Main Street Lending Program facilities. For example, a business that receives a new loan through the Main Street New Loan Facility may not also receive an expanded loan through the Main Street Expanded Loan Facility.

- Eligible Lenders: Businesses will need to seek loans from banks that qualify as eligible lenders under the Main Street Lending Program, which are U.S.-insured depository institutions, U.S. bank holding companies, and U.S. savings and loan holding companies. These eligible lenders are not construed or defined in the information released to date and these definitions are not expressly linked to the definitions in the Federal Deposit Insurance Act or the Bank Holding Company Act. Nonbank lenders, including fintechs, are not eligible to originate loans. Eligible commercial lenders will be responsible for underwriting, documenting and funding loans under the Main Street Lending Program, and prospective borrowers may seek to leverage existing banking, lending and financing relationships to seek such loans. As mentioned above, the participating lenders must retain 5% of the eligible loans and are subject to Federal Reserve oversight to ensure prudent lending practices.

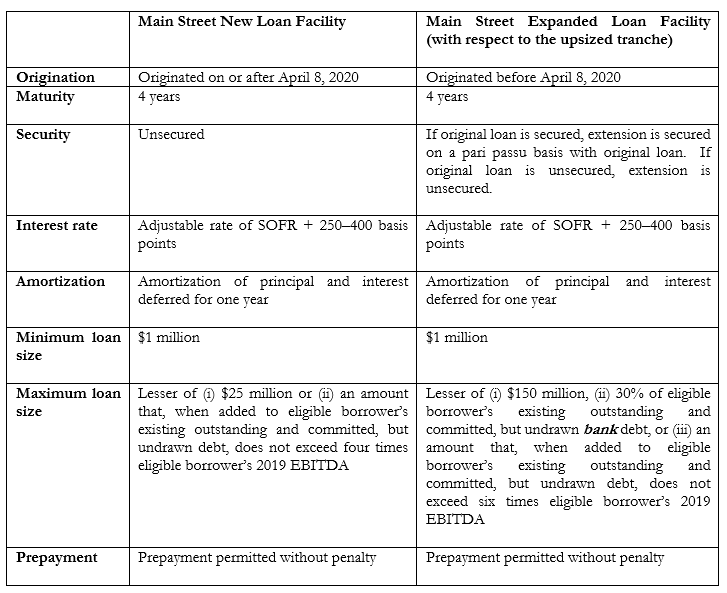

- Eligible Loans: An eligible loan is an unsecured term loan made by an eligible lender, except that, for loans under the Main Street Expanded Loan Facility, any collateral securing the original loan, whether such collateral was pledged under the original terms or at the time of upsizing, will secure the eligible loan (see chart below). For the Main Street New Loan Facility, eligible loans are those originated on or after April 8, 2020. For the Main Street Expanded Loan Facility, an eligible loan is one that originated before April 8, 2020, and has been subsequently upsized.

New loans—or the upsized tranche of existing loans—must have the following features:

In addition, in order for a loan to be deemed an eligible loan under either of the Main Street Lending Program facilities, the following attestations are required:

- Attestation by Borrowers: Eligible borrowers will be required to make certain attestations, including that (a) it will refrain from using the proceeds of the eligible loans to repay other loan balances, (b) it will refrain from repaying other debt of equal or lower priority, with the exception of mandatory principal payments, unless the borrower has first repaid the eligible loan in full, (c) it will not seek to cancel or reduce any of its outstanding lines of credit, (d) it requires financing due to the exigent circumstances presented by the COVID-19 pandemic, and that, using the proceeds of the loan or upsized tranche of the loan, as applicable, it will make reasonable efforts to maintain its payroll and retain its employees during the term of such loan, (e) it meets the EBITDA leverage condition described above that is a required feature of eligible loans, and (f) it will follow the executive compensation limitations, stock repurchase restrictions, and capital distribution restrictions that apply to direct loan programs under section 4003(c)(3)(A)(ii) of the CARES Act.4

- Attestation by Lenders: Eligible lenders will be required to make certain attestations, including that (a) proceeds of the eligible loan (or the upsized tranche of the eligible loan, as applicable) will not be used to repay or refinance pre-existing loans or lines of credit made by the eligible lender to the eligible borrower (including, in the case of the Main Street Expanded Loan Facility, the pre-existing portion of the eligible loan), (b) it will not cancel or reduce any existing lines of credit outstanding to the eligible borrower, and (c) the entity is eligible to participate in the Main Street Lending Programs, including in light of the conflicts of interest prohibition in section 4019(b) of the CARES Act.

- Use of Loan Proceeds: Businesses seeking Main Street Lending Program loans must commit to comply with a number of restrictions on how the proceeds of the loans may be used and other restrictions on actions that the business can take while the loans are outstanding. The conditions on use of loan proceeds are comparatively less restrictive than restrictions imposed on PPP borrowers, but more restrictive than those imposed on participants in other Federal Reserve relief programs.5 Borrowers must make “reasonable efforts,” using the proceeds of the loan, to maintain their payroll and retain their employees during the term of the loan. Unlike the PPP, the Main Street Lending Program does not set specific levels of employment that must be maintained. Borrowers may not use the proceeds of the loan to repay other loan balances.

- Facility, Origination and Servicing Fees:

- Loan participation fee: Solely with respect to a loan made under the Main Street New Loan Facility, the lender will be required to pay to the Federal Reserve a 100 basis point fee on the principal amount of the loan purchased via participation (e.g., 95% of the par value of the loan). This fee is permitted to be passed through to the borrower.

- Loan origination fee: The borrower shall pay an origination fee of 100 basis points of the principal amount of the loans under either the Main Street New Loan Facility or Main Street Expanded Loan Facility.

- Loan servicing fee: As consideration for the lender administering the loans, the Federal Reserve will pay to lender a per annum servicing fee of 25 basis points of the principal amount of the loans participated under either the Main Street New Loan Facility or Main Street Expanded Loan Facility.

- Main Street Lending Program Termination Date: The SPV will cease purchasing loan participations on September 30, 2020.

- Comment Period Through April 16: The Federal Reserve and Treasury are seeking input from lenders, borrowers, and other stakeholders as the program is finalized. Comments may be sent to the Federal Reserve through the Feedback Form on the Federal Reserve website (or by other means of communication) through April 16, 2020.

APPLICATION PROCESS

- The process has not yet been announced, but if the process for the PPP loans provides any guide, potential borrowers should expect:

- Treasury to issue a loan application, requesting:

- Basic company information, including ownership and historical employment levels.

- The size of the loan needed and the intended purpose for the funds received.

- Multiple attestations and certifications reflecting a commitment to the above requirements.

- A business’ current debt levels and servicing plan along with its financial statements.

- The economic impact of COVID-19 on the business and the lack of alternative, non-governmental funding sources.

- If the application is accepted, Treasury will likely provide a draft agreement to the applicant to govern the terms of the loan under either the Main Street New Loan Facility or the Main Street Expanded Loan Facility. As with the SBA application in connection with the PPP, the ability to negotiate terms in the agreement will likely be limited.

IMPLICATIONS FOR BOTH LENDERS AND BORROWERS

- Participation in Other Programs. Borrowers that have obtained financial assistance under the PPP should remain eligible for new loans and loan extensions under the Main Street Lending Program. Participation in the two Main Street Lending Programs are mutually exclusive, as extensions of new loans made to borrowers under the Main Street New Loan Facility will not be considered eligible loans under the Main Street Expanded Loan Facility, and new loans will not be available to borrowers under the Main Street New Loan Facility if the borrower’s loans were upsized under the Main Street Expanded Loan Facility.

- Work with Your Existing Lender. One of the incentives for lenders to participate in the Main Street Lending Program may be the 1% origination fee lenders can charge on a loan that they can then sell 95% of back to the SPV. Whether that incentive is enough for lenders to work with new business borrowers (versus existing borrowers at the lender) will be a facts-and-circumstances determination. For this reason and others (see below), for most businesses, working with their existing relationship banks will be key.

- Amendments to Existing Debt. Borrowers will need to carefully examine existing debt agreements to determine whether any amendments may be needed to permit incurrence of new or upsized loans. Because the loan proceeds under these programs cannot be used to pay off or refinance pre-existing debt, borrowers will need to work within the covenant restrictions of their current debt facilities. As such, exploring the willingness of existing lenders to provide waivers, even at this early juncture, would be wise.

- Preference of Upsized Loans? Since lenders will not be required to pay a participation fee to sell upsize loans to the Federal Reserve, there may be a preference for borrowers with existing debt facilities to request upsized loans (Main Street Expanded Loan Facility) in the form of incremental loans from their existing lenders rather than new loans (Main Street New Loan Facility). A lesson learned from the PPP program is that given the big demand from businesses for Treasury’s loan programs, most banks may focus first on providing financing to existing customers given administrative burdens and overwhelming demand from many prospective borrowers.

- Company Restrictions. The restrictions on dividends, stock buybacks and executive compensation may make these loans unattractive for many businesses. For example, under Section 4004 of the CARES Act, these restrictions generally cap executive compensation at 2019 levels for executives who received more than $425,000 total compensation in 2019 (with additional restrictions for those who received more).

- SOFR. The Federal Reserve has required that both new and upsize loans bear interest at the Secured Overnight Financing Rate (SOFR) plus a margin, rather than using the London Interbank Offered Rate (LIBOR) reference rate. Particularly in the context of upsize loans in the form of incremental debt, using SOFR may prove administratively difficult given that the majority of existing variable rate loan facilities set LIBOR as the reference rate.

- Document COVID-19 Impact. Because it is unclear at this stage what level of “due diligence” will be done by lenders, prospective borrowers may be wise to begin preparing backup support for the required attestations and other certifications. A particular focus should be on the COVID-19 impact on the business and the “reasonable efforts” they will make to maintain payroll and keep employees during the term of the loan.

- Additional Rulemaking. This program is at the very initial stage, and, as such, the terms of the Main Street Lending Program are subject to further rulemaking and guidance from Treasury and the Federal Reserve. This alert is a summary based on term sheets published by the Federal Reserve to date, and the scope of the program will become more clear as applications and standard operating procedures are implemented, similar to the rollout of the PPP.

Businesses should prepare an assessment now of their financial needs for the remainder of 2020 if considering seeking funding under the Main Street Lending Program. It is also advisable to collect any required information and fully understand the restrictions that will be imposed in exchange for this funding, as well as what long-term impacts on business operations or existing financing could occur.

1 On April 9, 2020, in the same release, the Federal Reserve also announced the establishment of several other new funding facilities supported by Treasury funding authorized by Section 4003(b)(4) of the CARES Act. The Federal Reserve also announced an expansion of the existing Primary and Secondary Market Corporate Credit Facilities (PMCCF and SMCCF) as well as the Term Asset-Backed Securities Loan Facility (TALF). See https://www.federalreserve.gov/newsevents/pressreleases/monetary20200409a.htm.

2 This information is subject to change as Treasury and the Federal Reserve develop and release additional guidance.

3 The Federal Reserve has not defined how the employee thresholds should be calculated, or whether the thresholds require prospective borrowers to aggregate their employee or revenue levels with those of their parents and/or affiliates (see the affiliation rules that apply to the CARES Act’s PPP). Further guidance from Treasury or the Federal Reserve may address this point.

4 Certain other borrower certifications under the CARES Act are mandated. As the Federal Reserve stated in the release, “[b]orrowers must also follow compensation, stock repurchase, and dividend restrictions that apply to direct loan programs under the CARES Act.”

5 The conditions are less restrictive than those imposed on the “Assistance for Mid-Sized Businesses” program, which was outlined in Section 4003(c)(3)(D)(i) of the CARES Act. This program was understood to be separate from, and more restrictive than, the Main Street Lending Program, which was referenced separately in Section 4003(c)(3)(D)(ii). The Main Street Lending Program adopted several of the restrictions defined in the CARES Act for the Assistance for Mid-Sized Businesses Program.