Loans to PPP Lenders: The Paycheck Protection Program Lending Facility

Publications - Client Alert | April 20, 2020Since the enactment of the Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”) on March 27, 2020, the Small Business Administration (the “SBA”) and the Treasury Department (“Treasury”) have issued a sizable number of rules and additional guidance to implement the CARES Act’s marquee small business loan component – the Paycheck Protection Program (the “PPP”).

On April 9, 2020, the Board of Governors of the Federal Reserve System (the “Federal Reserve”) announced the Paycheck Protection Program Lending Facility (the “PPPLF”) pursuant to the Federal Reserve’s emergency lending authority under section 13(3) of the Federal Reserve Act. The PPPLF was part of a broader announcement1 regarding the implementation of new and expanded federal lending programs, including the Main Street Lending Program aimed at making new loans available to businesses with up 10,000 employees. (For more on the Main Street Lending Program, see our special publication: CARES Act: The Launch of the Main Street Lending Program.)

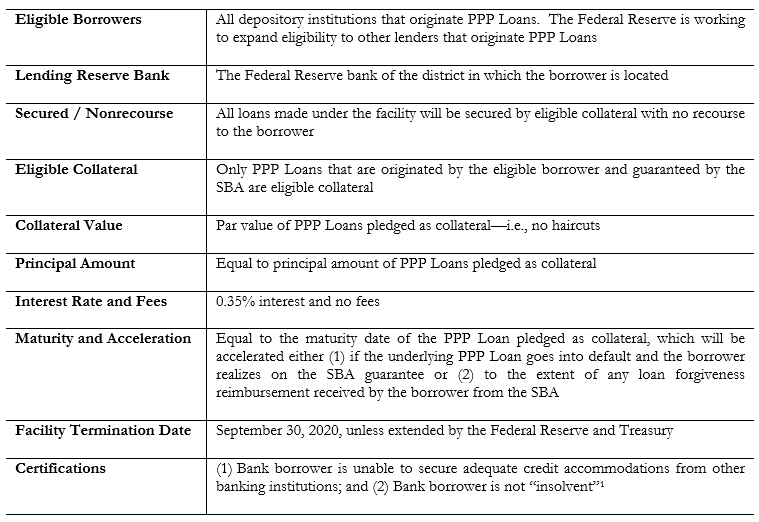

The PPPLF allows Federal Reserve banks to make direct non-recourse loans to PPP depository institution lenders2 that originate PPP loans (“PPP Loans”) equal to the amount of and secured by such loans. The initial terms of the PPPLF are summarized in a term sheet released by the Federal Reserve in conjunction with its announcement. The purpose of the PPPLF is to increase liquidity for lenders participating in the PPP (a “PPP Lender”) to expand origination of PPP Loans. Under the PPPLF, Federal Reserve banks will extend to PPP Lenders non-recourse term loans (“PPPLF Loans”) at an interest rate of 0.35%. A PPP Loan serves as collateral for a corresponding PPPLF Loan (with such collateral valued at the principal amount of the PPP Loan). PPP Lenders will not be charged fees to borrow from the PPPLF.

The terms of a PPPLF Loan are aligned with the underlying PPP Loan serving as collateral. The maturity date of a PPPLF Loan will be the maturity date of the underlying PPP Loan, and the maturity date will be accelerated (1) in conjunction with the acceleration of an underlying PPP Loan upon a default and resulting sale to the SBA by the PPP Lender of such PPP Loan to realize on the 100% guarantee, and (2) to the extent of any loan forgiveness reimbursement received by a PPP Lender from the SBA in respect of the underlying PPP Loan.

Key Terms of the PPPLF:

As noted above, bank applicants for PPPLF must certify to certain facts relevant to their eligibility to participate in the PPPLF. This includes a certification that bank “[b]orrower is unable to secure adequate credit accommodations from other banking institutions.” The Federal Reserve has said that in making this certification as to the inability to secure “adequate credit” elsewhere, applicants “may rely on the fact that the Board of Governors authorized the establishment of the PPPLF to improve the ability of PPP lenders to obtain reasonably priced long-term financing for PPP Loans.”4 This guidance from the Federal Reserve would hopefully provide a good basis for the certification, which the bank borrower supplements with documentation that no comparable third party financing was available.

PPPLF applicants should carefully reason, monitor and document their compliance with PPPLF funding program requirements. This should include the certifications made to receive the funds as well as sufficient records and documentation substantiating any certifications.

REGULATORY CAPITAL TREATMENT

Under Section 1102 of the CARES Act, a PPP Loan originated by a PPP Lender will be assigned a risk weight of zero percent under the risk-based capital rules of the federal banking agencies.5 In addition, on April 9, 2020, the federal banking agencies issued an interim final rule (the “rule”) modifying the agencies’ capital rules in order to encourage lending through the PPP.6 In issuing the rule, the agencies sought to “neutralize the regulatory capital effects of participating in the Federal Reserve’s PPP facility because there is no credit or market risk in association with PPP loans pledged to the facility.” Specifically, the rule permits a banking organization to exclude exposures pledged as collateral to the PPPLF from the banking organization’s total leverage exposure, average total consolidated assets, advanced approaches total risk-weighted assets and standardized total risk-weighted assets, as applicable.7 The rule became effective immediately and is open for comment until May 13, 2020.

As with the other federal programs implemented in connection with the CARES Act, it is reasonable to expect that the contours of the PPPLF will evolve significantly in the coming days and weeks.

For more information, please contact an attorney listed below.

Loans to PPP Lenders: The Paycheck Protection Program Lending Facility

1 https://www.federalreserve.gov/newsevents/pressreleases/monetary20200409a.htm

2 The term sheet says that the Fed is working on expanding the facility to non-depository institution PPP lenders that originate PPP loans.

3 The borrower certifications are required to ensure that the Federal Reserve banks meet their statutory requirements for lending programs established under Section 13(3) of the Federal Reserve Act, such as the PPPLF.

4 See Federal Reserve PPPLF FAQs at https://www.frbdiscountwindow.org/pages/general-information/faq.

5 CARES Act § 1102(a)(2) (adding §(36)(O)(i) to §7(a) of the Small Business Act).

6 Federal Reserve, Federal Deposit Insurance Corporation (FDIC) and Office of the Comptroller of the Currency (OCC), Joint Press Release: Federal Bank Regulators Issue Interim Final Rule for Paycheck Protection Program Facility (Apr. 9, 2020), available at https://www.federalreserve.gov/newsevents/pressreleases/bcreg20200409a.htm.

7 OCC, Federal Reserve and FDIC, Regulatory Capital Rule: Paycheck Protection Program Lending Facility and Paycheck Protection Program Loans, 85 Fed. Reg. 20387 (Apr. 13, 2020), available at https://www.federalregister.gov/documents/2020/04/13/2020-07712/regulatory-capital-rule-paycheck-protection-program-lending-facility-and-paycheck-protection-program.