FTC Announces Hart-Scott-Rodino Thresholds for 2023

Publications - Client Alert | January 27, 2023The Federal Trade Commission (FTC) has announced the following annual adjustments of the Hart-Scott-Rodino (HSR) filing thresholds (15 USC § 18a, Clayton Act § 7A) (88 FR 5004). These thresholds will apply to stock and asset acquisitions, mergers, consolidations, joint ventures and similar transactions closing on or after Feb. 27, 2023.

- All transactions valued at not more than $111.4 million will be exempt from all HSR filing and waiting period requirements (assuming no prior or related transactions between the parties or their affiliates); an increase from last year’s $101.0 threshold.

- All transactions valued at $445.5 million and over, not otherwise exempt under one of the many substantive HSR exemptions, will require a pre-acquisition filing and will need to observe the 30-day waiting period requirement (subject to possible early termination, if/when fully reinstated).

- Most (non-exempt) transactions valued between $111.4 million and $445.5 million will likely require a filing based on the “size-of-the-person” test (with size-of-the-person thresholds being adjusted to $22.3 million and $222.7 million).

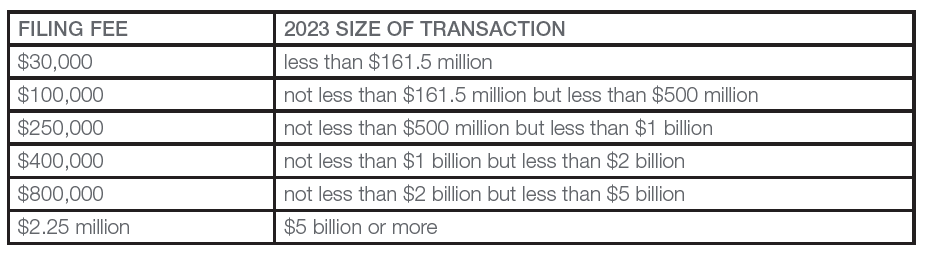

There is also a recently announced new six-tier structure HSR filing fees, rather than three tier. The filing fee has been lowered for certain transactions ($30,000 for transaction valued under $161.5 million), but increased substantially for others, particularly for acquisitions valued at more than $1 billion. The HSR filing fees will now also be adjusted annually starting in 2024. These higher fees may lead to more negotiations over responsibility for payment of the HSR fee, which by regulation is due from the acquiring party, unless otherwise agreed. The new filing fee structure based on the 2023 structures is below:

Additionally, substantive amendments have been made to the HSR disclosure requirements for transactions already requiring an HSR filing (Merger Filing Fee Modernization Act, Dec. 29, 2022). Parties engaging in a reportable transaction will be required to disclose any subsidies (broadly defined, including government ownership interests and tax breaks) received from “foreign entities of concern,” including entities owned or controlled by or receiving subsidies from China, Iran, North Korea, Russia and other designated entities. These additional reporting requirements will go into effect after adoption of implementing regulations by the FTC, which is expected later this year.

The Kutak Rock antitrust team has longstanding experience and expertise in HSR pre-merger filings. In addition to preparing the necessary HSR filing documents and communicating with the FTC and DoJ, we also analyze transactions to determine if they are exempt from the HSR filing requirements, counsel on pre-closing restrictions concerning the operations of the acquired entity and advise on structuring transactions to avoid or minimize both potential antitrust problems and costly second requests.

If you have an upcoming merger, consolidation, stock purchase or asset acquisition, please give us a call.