ESG Bond Considerations for Housing Finance Agencies

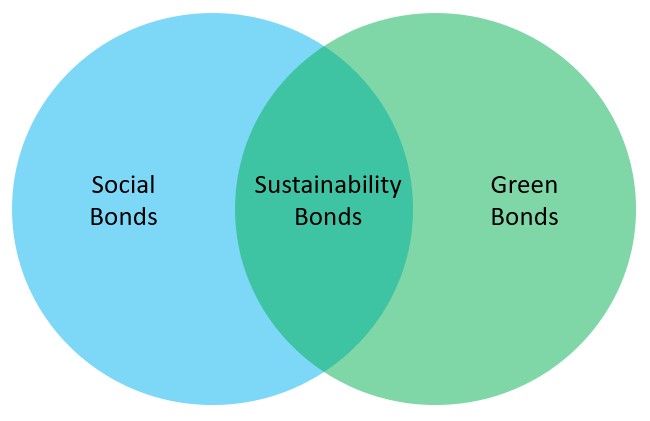

Publications - Client Alert | January 19, 2021The designation of certain affordable housing bond issuances as ESG (Environmental, Social, and Governance) bonds is quickly expanding, prompting questions about what designation may mean for State Housing Finance Agencies (HFAs). ESG bonds are sometimes referred to as “labeled bonds” and include Social, Green and Sustainable Bonds which satisfy the criteria developed by the International Capital Markets Association (ICMA). These designations may create new opportunities for HFAs, such as broadening the bond investor base or possibly providing an interest rate advantage, but they also create new questions and some new legal issues. The following is a brief overview of key considerations for HFAs considering an ESG/labeled bond designation.

Social Bonds Overview

Social Bonds were developed by ICMA to enable and develop the role debt markets play in funding projects that address global social challenges. ICMA defines Social Bonds as bond instruments that finance or refinance new or existing Social Projects and align with ICMA’s Social Bond Principles (SBP). The four core components of the SBP are:

- Use of proceeds;

- Process for project (program) evaluation and selection;

- Management of proceeds; and

- Reporting.

Affordable housing is one type of Social Project expressly described by ICMA, and target populations include those with low income or who are otherwise underserved.

Simply by virtue of complying with existing requirements under federal tax and state laws, HFAs may find that satisfying SBP for some affordable housing issuances is relatively straightforward. This is because the criteria for bonds to meet SBP are generally described as principles or guidelines, while federal tax and state laws contain concrete requirements and legal consequences for failing to meet those requirements.

For example, while the SBP may support “affordable housing” generally, for single-family bonds the federal tax code contains specific limits to home purchase price and homeowner income. Similarly, for multifamily bonds, with respect to the housing units being financed, generally either 20% of residential units must be occupied by individuals whose income is less than 50% of the area median gross income, or 40% of residential units must be occupied by individuals whose income is less than 60% of the area median gross income.

Green Bonds Overview

The proceeds of Green Bonds must be used to finance or refinance eligible Green Projects in a manner consistent with Green Bond Principles (GBP). GBP are comprised of the same core components as Social Bonds (use of proceeds; process for project evaluation and selection; management of proceeds; and reporting). Green Project categories include but are not limited to use of proceeds for:

- Renewable energy,

- Energy efficiency,

- Sustainable water and wastewater management; and

- Green buildings.

The GBP do not designate particular green technologies, standards, or claims for environmentally sustainable benefits, but instead refer to other international and national standards. Some HFAs have established their own standards for design and construction, while others use utility benchmarking to monitor the performance of properties and utilities. Areas of “green” initiatives employed by HFAs include energy efficiency, water conservation, and use of sustainable building processes.

Sustainability Bonds Overview

Sustainability Bonds are those bonds where proceeds are applied to a combination of both Green and Social Projects. HFAs should determine whether issues qualify as Sustainability Bonds by applying the core components of the SBP and GBP. If an issuance meets the criteria for both Social Bonds and Green Bonds, the issue is also a Sustainability Bond.

Things to Consider

HFAs may encounter novel legal and regulatory issues when designating bonds as Social, Green or Sustainable:

- Should the HFA itself designate the bonds as ESG bonds—so called “self-designation”—or in lieu of self-designation obtain a second-party opinion or certification?

- Will the HFA use past data as a predictor of future performance to designate bonds as Social Bonds or Green Bonds, or will it obligate itself to spend the proceeds consistent with the SBP/GBP?

- The “soft” nature of the SBP or GBP may allow HFAs to designate an issue based on historical use of similar bonds. On the other hand, the requirement that bonds comply with federal tax and state laws may allow the HFA to commit to use the proceeds of the bonds in compliance with the SBP/GBP. Several factors should be considered when deciding to use past performance or a future commitment to designate bonds, including the predictability of the use of bond proceeds and whether the designation is being made by the HFA or a second-party verifier.

- What continuing disclosure obligations are assumed by designating bonds as labeled bonds?

- A commitment to use bond proceeds in a manner consistent with the SBP or GBP typically involves a future description of how the proceeds were spent. Any such report should be voluntary (and expressly described as such) and not subject to the requirements for continuing disclosure under SEC Rule 15c2-12. HFAs should make appropriate representations to investors to ensure that failure to satisfy SBP or GBP does not result in financial default.

- Are there unique considerations involved with designating refunding bonds as ESG bonds when the refunded bonds were not EGS bonds?

- ICMA has stated that refunding is an appropriate use of labeled bond proceeds when the refunded bond projects satisfy the core components of the SBP or GBP at the time of the refunding.

- What other legal concerns are there in this emerging area?

- HFAs should consider who addresses the materiality of statements in official statements, the use of labels or logos and possible permissions needed to use them, and securities law considerations if investor presentations are part of a bond offering.

HFAs should fully consider these issues and discuss them with counsel, the lead underwriter, and financial advisor in order to determine whether designation as labeled bonds is the right choice under the circumstances.

Additional Information

If you have questions about any of the foregoing, please contact any of the attorneys in Kutak Rock’s Housing Finance Agency Practice Group. We would be happy to discuss this with you.